By Walter Kurtz, Sober Look

Staying with the theme of bearish sentiment in commodity markets, crude oil came under severe pressure recently. Based on today’s data, US crude inventory actually declined last week, surprising some forecasters who expected crude stocks to continue rising. One would expect lower inventories to result in higher prices, but that did not occur. Instead WTI futures took a 2% hit today, reaching a 10-month low.

Here are some of the explanations from market participants for these violent moves to the downside:

1. Weaker than expected growth in China has precipitated a negative sentiment in commodity markets (see discussion).

2. Major commodity investors such as hedge funds have been unwinding positions.

3. Today we saw what could amount to weaker than expected demand for gasoline in the US, as more drivers stay home.

EIA: – Over the last four weeks, motor gasoline product supplied has averaged over 8.4 million barrels per day, down by 3.3 percent from the same period last year

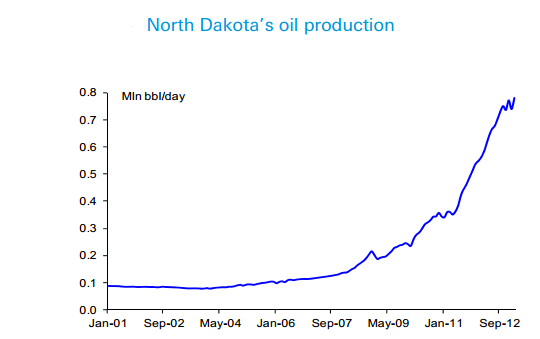

4. The non-OPEC crude oil production, particularly out of North America continues to surprise. The Deutsche Bank chart below, showing North Dakota’s oil production, is giving some long oil investors a pause for concern (in some cases nightmares).

DB: – “The latest production data out of North Dakota, home to the prolific Bakken shale, reflects the strength of US production as output hit a record 780kbd in February after dipping in January as cold weather hindered operations. Production in the state is up nearly 40% YTD. According to Lynn Helms, Director of North Dakota’s Department of Mineral Resources, the state is likely to reach 800kbd in May once weather conditions improve. Helms also said the state is on track to reach production of 850kbd by early 2014. We note that if North Dakota’s production averages about 800kbd this year, which would be up from last year’s average production rate of 663kbd, this would be equal to over 70% of non-OPEC’s estimated total supply growth for this year, according to the IEA.”

All this is good news from the Fed’s perspective, giving the central bank incremental room for monetary expansion. It’s unclear where the Fed-induced bubble will show up, but for now it’s not in commodities.

The post 4 Reasons for Oil’s Recent Volatility appeared first on PRAGMATIC CAPITALISM.