Earlier:

• Summary for Week Ending April 19th

The key reports this week are the Q1 advance GDP report to be released on Friday, New home sales for March on Tuesday, and existing home sales for March on Monday.

There are also two more regional manufacturing surveys to be released this week.

—– Monday, Apr 22nd —–

8:30 AM ET: Chicago Fed National Activity Index for March. This is a composite index of other data.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR).

The consensus is for sales of 5.03 million on seasonally adjusted annual rate (SAAR) basis. Sales in February were at a 4.98 million SAAR. Economist Tom Lawler is estimating the NAR will report a March sales rate of 4.89 million.

A key will be inventory and months-of-supply.

—– Tuesday, Apr 23rd —–

9:00 AM: The Markit US PMI Manufacturing Index Flash for April. The consensus is for a decrease to 54.2 from 54.9 in March.

10:00 AM: New Home Sales for March from the Census Bureau.

10:00 AM: New Home Sales for March from the Census Bureau.

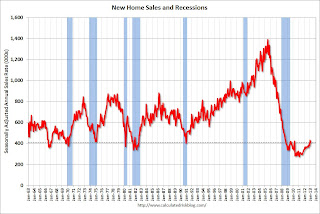

This graph shows New Home Sales since 1963. The dashed line is the February sales rate.

The consensus is for an increase in sales to 419 thousand Seasonally Adjusted Annual Rate (SAAR) in March from 411 thousand in February.

10:00 AM: FHFA House Price Index for February 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.7% increase

10:00 AM: Richmond Fed Survey of Manufacturing Activity for April. The consensus is for a reading of 3.0 for this survey, unchanged from March (Above zero is expansion).

—– Wednesday, Apr 24th —–

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for March from the Census Bureau. The consensus is for a 2.8% decrease in durable goods orders.

During the day: The AIA’s Architecture Billings Index for March (a leading indicator for commercial real estate).

—– Thursday, Apr 25th —–

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 350 thousand from 352 thousand last week. The “sequester” budget cuts might be starting to impact weekly claims.

11:00 AM: Kansas City Fed regional Manufacturing Survey for April. The consensus is for a reading of minus 1, up from minus 5 in March (below zero is contraction).

—– Friday, Apr 26th —–

8:30 AM: Q1 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 3.1% annualized in Q1.

8:30 AM: Q1 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 3.1% annualized in Q1.

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

The Red column (and dashed line) is the consensus forecast for Q1 GDP.

9:55 AM: Reuter’s/University of Michigan’s Consumer sentiment index (final for April). The consensus is for a reading of 73.0, up from 72.3.