The Census Bureau reported that overall construction spending decreased in March:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during March 2013 was estimated at a seasonally adjusted annual rate of $856.7 billion, 1.7 percent below the revised February estimate of $871.2 billion. The March figure is 4.8 percent above the March 2012 estimate of $817.8 billion.

Both private construction and public construction spending decreased (residential increased, non-residential decreased):

Spending on private construction was at a seasonally adjusted annual rate of $598.4 billion, 0.6 percent below the revised February estimate of $602.0 billion. Residential construction was at a seasonally adjusted annual rate of $294.9 billion in March, 0.4 percent above the revised February estimate of $293.8 billion. Nonresidential construction was at a seasonally adjusted annual rate of $303.5 billion in March, 1.5 percent below the revised February estimate of $308.2 billion. …

In March, the estimated seasonally adjusted annual rate of public construction spending was $258.3 billion, 4.1 percent below the revised February estimate of $269.2 billion.

Click on graph for larger image.

Click on graph for larger image.

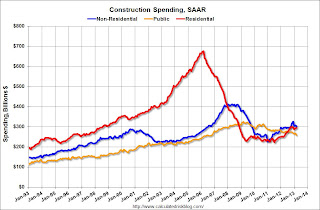

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 56% below the peak in early 2006, and up 33% from the post-bubble low. Non-residential spending is 27% below the peak in January 2008, and up about 34% from the recent low.

Public construction spending is now 21% below the peak in March 2009 and at the lowest level since 2006 (not inflation adjusted).

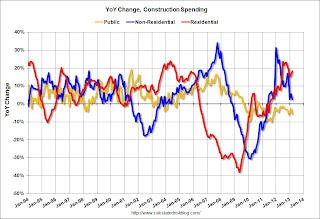

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.

On a year-over-year basis, private residential construction spending is now up 18%. Non-residential spending is up 3% year-over-year mostly due to energy spending (power and electric). Public spending is down 5.4% year-over-year.

A few key themes:

1) Private residential construction is usually the largest category for construction spending, but there was a huge collapse in spending following the housing bubble (as expected). Private residential is now about even with private non-residential, and residential will probably be the largest category of construction spending in 2013. Usually private residential construction leads the economy, so this is a good sign going forward.

2) Private non-residential construction spending usually lags the economy. There was some increase this time, mostly related to energy and power – but the key sectors of office, retail and hotels are still at very low levels.

3) Public construction spending has declined to 2006 levels (not adjusted for inflation). This has been a drag on the economy for 4 years. In real terms, this is the lowest level of public construction spending since February 2001.