I’d like to reply to one confusion and one set of pushbacks on yesterday’s post:

Currency and Reserve Balances

I buried one fact: banks can reduce total Fed reserve balances by withdrawing currency — physical cash — from their Fed reserve accounts. I only gestured toward this in a parenthetical and a link. It’s a trivial point for this discussion, but it raises confusion. This is the other thing (besides bonds) that the Fed issues and retires in return for reserve balances. As with bonds, it’s purely an exchange between banks and the Fed (though it’s driven by customers’ cash needs).

Banks actually have nominal control over this. The Fed has to issue currency to them (retiring reserves in exchange) when they ask for it, and they have to retire currency (issuing reserve balances) when banks send it back.

But this in no way suggests that reserve balances are money. You can withdraw currency (notes) from your bank. Does that mean that your checking account contains currency? That checking deposits are currency? No.

This issue is unimportant here because it’s essentially a mechanical function. As long as it’s working properly — ATMs dispense cash and people can deposit cash — it has no effect on things. (And cash is pretty small magnitude in the total system). Banks keep enough cash on hand to handle their customers needs, and the Fed accomodates that. Aside from drug dealers, etc., nobody holds much physical currency.

The only reason cash would be an important consideration would be if the Fed starting paying (significant) negative interest on reserve balances — charging the banks to to hold their reserve deposits. Banks might decide to build secure warehouses and drive cash to and from the Fed, trading it for reserve balances, when they needed to fund loans or when loans got paid off. (It’s kinda tricky to fund a $400,000 mortgage with cash…)

Otherwise it’s a nonissue for this discussion. But I should have made it clear.

Whaddaya Mean by M, Buster?

People really don’t like the idea that the Fed’s not printing “money.” MV=PY adherents especially object.

Let’s look at the standard definitions. None of the monetary aggregate definitions M0 through MZM includes reserve balances. By those definitions, reserves are not money. (Ditto the divisia measures.) So by those definitions, when the Fed issues new reserves, it’s not “printing money.”

The one exception is the “Monetary Base,” or “base money.” That definition of money includes currency, coins, and reserves. Here’s a handy chart from Wikipedia:

| Type of money | M0 | MB | M1 | M2 | M3 | MZM |

|---|---|---|---|---|---|---|

| Notes and coins in circulation (outside Federal Reserve Banks and the vaults of depository institutions) (currency) | ✓[8] | ✓ | ✓ | ✓ | ✓ | ✓ |

| Notes and coins in bank vaults (Vault Cash) | ✓ | |||||

| Federal Reserve Bank credit (required reserves and excess reserves not physically present in banks) | ✓ | |||||

| Traveler’s checks of non-bank issuers | ✓ | ✓ | ✓ | ✓ | ||

| Demand deposits | ✓ | ✓ | ✓ | ✓ | ||

| Other checkable deposits (OCDs), which consist primarily of Negotiable Order of Withdrawal (NOW) accounts at depository institutions and credit union share draft accounts. | ✓[9] | ✓ | ✓ | ✓ | ||

| Savings deposits | ✓ | ✓ | ✓ | |||

| Time deposits less than $100,000 and money-market deposit accounts for individuals | ✓ | ✓ | ||||

| Large time deposits, institutional money market funds, short-term repurchase and other larger liquid assets[10] | ✓ | |||||

| All money market funds | ✓ |

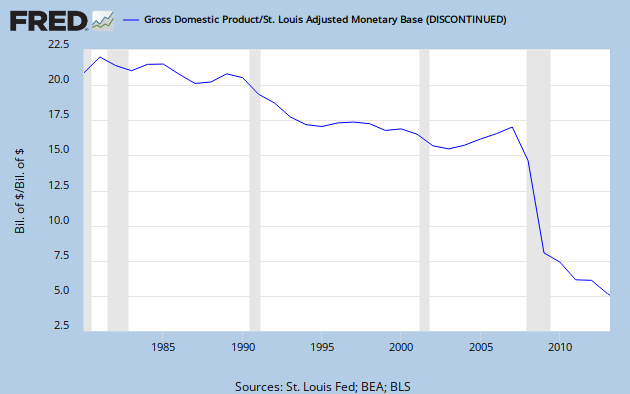

So fine: M in the equation of exchange means Base Money. But if you look at the data using that definition, it seems like there’s some serious explainin’ to do. Here’s the velocity of MB:

A 60+% decline since 2008? Hmm…

Cross-posted at Asymptosis.