Container traffic gives us an idea about the volume of goods being exported and imported – and possibly some hints about the trade report for April since LA area ports handle about 40% of the nation’s container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

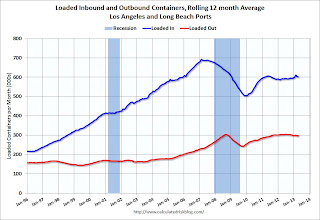

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 2% in April, and outbound traffic down 2%, compared to the rolling 12 months ending in March.

In general, inbound traffic has been increasing slightly recently, and outbound traffic has been mostly moving sideways.

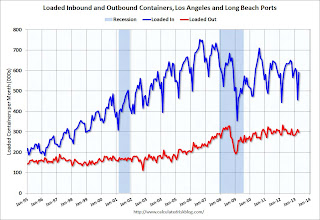

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year). This year imports bottomed in March, and bounced back in April.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year). This year imports bottomed in March, and bounced back in April.

My guess is this suggests an increase in the trade deficit with Asia for April.