The key reports this week are the April existing home sales on Wednesday, and the April new home sales report on Thursday.

On Wednesday, Fed Chairman Ben Bernanke will provide testimony on the Economic Outlook, before the Joint Economic Committee, U.S. Congress. Also on Wednesday, the FOMC minutes for the most recent meeting will be released.

—– Monday, May 20th —–

8:30 AM ET: Chicago Fed National Activity Index for April. This is a composite index of other data.

—– Tuesday, May 21st —–

No economic releases scheduled.

—– Wednesday, May 22nd —–

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

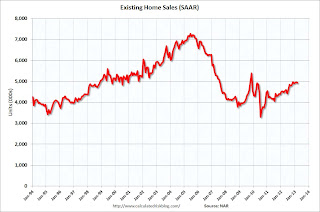

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR).

The consensus is for sales of 5.00 million on seasonally adjusted annual rate (SAAR) basis. Sales in March were at a 4.92 million SAAR. Economist Tom Lawler is estimating the NAR will report a April sales rate of 5.03 million.

A key will be inventory and months-of-supply.

10:00 AM: Testimony by Fed Chairman Ben Bernanke, Economic Outlook, Before the Joint Economic Committee, U.S. Congress

2:00 PM: FOMC Minutes for Meeting of April 30-May 1, 2013

During the day: The AIA’s Architecture Billings Index for April (a leading indicator for commercial real estate).

—– Thursday, May 23rd —–

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 345 thousand from 360 thousand last week.

9:00 AM: FHFA House Price Index for March 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.9% increase

9:00 AM: The Markit US PMI Manufacturing Index Flash for May. The consensus is for a decrease to 50.8 from 52.0 in April.

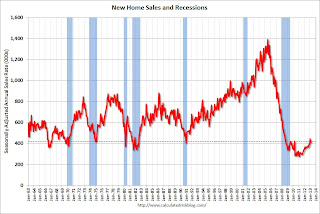

10:00 AM: New Home Sales for April from the Census Bureau.

10:00 AM: New Home Sales for April from the Census Bureau.

This graph shows New Home Sales since 1963. The dashed line is the March sales rate.

The consensus is for an increase in sales to 425 thousand Seasonally Adjusted Annual Rate (SAAR) in April from 417 thousand in March.

11:00 AM: Kansas City Fed regional Manufacturing Survey for May. The consensus is for a reading of minus 2, up from minus 5 in April (below zero is contraction).

—– Friday, May 24th —–

8:30 AM: Durable Goods Orders for April from the Census Bureau. The consensus is for a 1.1% increase in durable goods orders.

SIFMA recommends 2:00 PM market close on Friday in Observance of the Memorial Day Holiday.