Curve Watchers Anonymous continues to follow the rise in treasury yields. Here are a couple of charts.

$TNX: 10-Year Treasury Yield

Yield on the 10-year note has risen from 1.614% to 2.664% since the beginning of May. The following chart provides a better historical perspective.

Yield Curve As Of 2013-07-20

click on chart for sharper image

- $TYX 30-Year Treasury Bond Yield: Green

- $TNX 10-Year Treasury Note Yield: Orange

- $FVX 05-Year Treasury Note Yield: Blue

- $IRX 03-Month Treasury Bill Discount Rate: Brown

The rise in yields have wreaked havoc in the bond markets and even more so in mortgage-related Real Estate Investment Trusts (REITs).

REITs Deepening Bond Losses as Leverage Forces Sales

Bloomberg reports REITs Deepening Bond Losses as Leverage Forces Sales

Annaly Capital Management Inc. (NLY)’s Wellington Denahan, head of the largest mortgage real-estate investment trust, told investors less than three months ago that reports REITs could threaten U.S. financial stability were as misleading as the media frenzy over shark attacks in 2001.

Since the May 2 comments, shares of the companies, which use borrowed money to make $400 billion in credit market bets, dropped about 19 percent through yesterday and the value of their assets has plunged after the Federal Reserve triggered a flight from bond funds by signaling plans to slow its debt-buying program.

REITs may have needed to sell about $30 billion of government-backed mortgage securities in just one week last month to maintain the amount of borrowing relative to their net worth, according to JPMorgan Chase & Co. Those types of sales deepened losses in the mortgage-bond market, which had the worst quarter since 1994, accelerated the exit from fixed-income funds and fueled a jump in home-loan rates to a two-year high.

Mortgage rates jumped to 4.46 percent at the end of June, up from a near-record low of 3.35 percent in early May, after the central bank indicated it will taper its monthly debt buying, including $40 billion of government-backed housing debt.

Firms including Annaly, American Capital Agency Corp. (AGNC), the second biggest of the companies, and Armour Residential REIT Inc. (ARR), sell shares to the public so the capital can’t be redeemed. They also rely on leverage, typically using about six to eight times the amount of borrowed money compared with their capital.

That means they benefited from cheap financing as the Fed kept short-term interest rates near zero for more than four years. REITs more than tripled holdings of government-backed home-loan bonds since 2009 and their increased buying power helped push down mortgage rates.

Leverage Sharks Bite

Bloomberg reports “Annaly’s Denahan presented her shark analogy after Fed Governor Jeremy Stein referenced mortgage REITs in a February speech on how credit markets were showing signs of potentially excessive risk-taking.“

Mortgage REITs Stumble

Morningstar reports No Surprises Here: Mortgage REITs Stumble

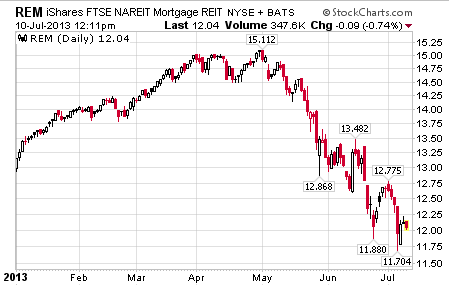

Mortgage REITs are a polarizing asset, either loved (for their yield) or despised (for their risk) by investors. The bears must be feeling vindicated now, as the market’s emotional response to the Fed’s recent announcements sent iShares Mortgage Real Estate Capped (REM) into a nosedive since the beginning of April. REM lost a stomach-churning 19% over the past three months, driven by instability in the yield curve and falling book values.

Not to be confused with equity REITs, which generate income by managing properties and collecting rent, mortgage REITs are financial firms that arbitrage the spread between the short-term interest rate and income from mortgage-backed securities. Mortgage REITs do not have access to deposit funding, so they rely on short-term loans like repurchase agreements. The largest firms purchase federally guaranteed securities from Freddie Mac and Fannie Mae.

Mortgage REITs are very susceptible to the risk of rising short-term rates. Until recently, mortgage REITs have benefited from the Fed’s easy money policy. The Fed’s historically low near-zero interest rate makes financing cheap, allowing mortgage REITs to use leverage to provide an attractive yield. However, because these firms are so extensively leveraged, they are very susceptible to interest-rate fluctuations. The majority of mortgage REIT financing is as short term as 30 days, so if the capital markets freeze, these firms could be forced to accept unfavorable terms. Lenders also can make margin calls following a market decline. Either situation could force mortgage REITs to raise capital through share issuance.

Historical evidence is not encouraging: Mortgage REITs cut their distributions and performed poorly during past rising rate environments. REM’s two major holdings, Annaly Capital Management (NLY) (17.5% of assets) and American Capital Agency (AGNC) (13%), unsurprisingly cut their distributions even further in June after continued sell-offs. Both companies reduced their dividends last year as well. Because REM’s distributions (which are more volatile than payouts from equity REITs or the broad market) account for as much as 80% of the fund’s total return, declines in payouts considerably reduce return.

REM Daily Chart – Mortgage REITs

Investors and hedge funds plowed into REITs believing treasury and mortgage rates would stay low forever. And they are still low historically. But if the secular low in treasury and mortgage yields is in, these kind of losses will accumulate.

Leverage runs both ways.