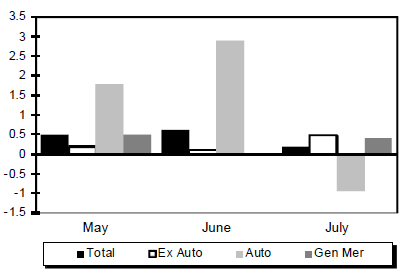

The Census Bureau reports retail sales rose for a fourth consecutive month, up 0.2% in July. Retail sales missed economist expectations of a 0.3% rise, but June month was revised up.

Retail Sales vs. Previous Months

July 2013 Retail Sales vs. July 2012

I am not sure how much longer auto sales will lead retail sales, but sooner or later, a huge plunge is in store.

With mortgage rates generally tied to the 10-year treasury yield, housing is already under pressure from the rise in treasury yields.

Treasury Yields

Overall, retail sales were strong enough to push treasury yields back towards the July high.

The next three charts show treasury yields multiplied by 10. Shift the decimal point one digit to the left for an accurate read.

$TNX 10-Year Treasury Yield

$TYX 30-Year Treasury Yield

$FVX 5-Year Treasury Yield

Historical Perspective

Curve Watchers Analysis captured the following chart this morning.

click on chart for sharper image

- $TYX: 30-Year Treasury Yield – Green

- $TNX: 10-Year Treasury Yield – Orange

- $FVX: 05-Year Treasury Yield – Blue

- $IRX: 03-Mnth Treasury Yield – Brown

Tapering Expectations

Bloomberg reports Bernanke Seen Slowing QE to $65 Billion in September.

Federal Reserve Chairman Ben S. Bernanke in September will trim the Fed’s monthly bond buying to $65 billion from the current pace of $85 billion, according to a growing number of economists surveyed by Bloomberg News.

Half of economists held that view in the July 18-22 survey, up from 44 percent in last month’s poll.

After today’s rise in treasury yields, that number is likely more than 50% and/or the expected tapering amount greater than $20 billion.

It will be interesting to watch the Fed’s reaction when housing and autos slump, the stock market takes a hit, and treasury yields continue to rise in the next few months.

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com