Bloomberg writer Caroline Baum pinged me with her latest article Ivory Tower Types Fall for Bigger Inflation Fix complete with a veritable “Who’s Who” of inflation proponents.

Inflation Proponents

- Kenneth Rogoff – Harvard University economist

- Greg Mankiw – Harvard professor

- Olivier Blanchard – IMF Chief Economist

- Noah Smith – Economist author of the “Not Quite Noahpinion” blog

The biggest missing entry was Paul Krugman.

Harvard economist Kenneth Blanchard says “the benefits of a 4 percent inflation target might outweigh the costs”

Rogoff goes even further, recommending “a short burst of moderate inflation” — two years of 6 percent inflation — would speed the deleveraging process.”

Mankiw emailed Baum “Think of it as the Fed announcing it will keep future short rates lower, for any given inflation rate, than it otherwise would have”

Baum offered a series of pertinent rebuttals:

“If a 6 percent inflation target would accelerate the deleveraging process, why stop there? Why not 8 percent? Or 10 percent? Wouldn’t that speed the process? You get the point.”

“In theory, Mankiw is right. Ceteris paribus — Latin for with other things equal. But other things aren’t equal; they never are.”

“In the real world, bond investors are going to look at 6 percent inflation and project 8 percent or 10 percent. Nominal bond yields will rise to incorporate higher inflation expectations. Real yields might not rise, but it’s unlikely they would fall. And long-term rates are what matter for capital investment, which is key to increasing the economy’s growth potential and raising productivity.”

What Baum Left Out

Baum’s rebuttal was well stated. However, she forgot to mention that asset bubbles that do not even count as “inflation”. What about the housing bubble? The dotcom bubble? They don’t count either, at least to the Fed.

We are in this mess precisely because of inflation. The Fed does not even know how to measure it.

From 1997-2000 the Fed ignored a major bubble in the stock market.

From 2003-2006 the Fed ignored major bubbles in home prices, then commercial real estate

Here’s the deal: The Fed can inflate money supply, but it cannot control where the money goes. And typically monetary inflation goes into asset bubbles (which the Fed ignores until they burst). Then in an effort to bail out the banks (typically overweight bubble assets) the Fed steps on the gas again.

The end result of inflation is a series of boom-bust cycles of ever-increasing amplitude.

The biggest losers in these inflationary boom-bust scenarios are those with last access to money and credit, typically the poor. The housing bust is a prime example. By the time those lowest on the totem pole had access to credit, it was far, far too late to buy houses to benefit from inflation.

Bernanke brags “inflation” has been lower under him than any other Fed chairman. He conveniently ignores the fact he was on the Fed in the Greenspan years, that he presided over the biggest property bubble in history, and he also ignores the stock market bubble we are in now.

Bernenke is now stepping aside, hoping to pass the buck to Janet Yellen or Larry Summers. How Convenient!

For a comparative analysis of the leading candidates to replace Bernanke, please see Tweedle Dum vs. Tweedle Dee; Does Janet Yellen Have What It Takes?

Totally Ignoring Reality

Baum referred to inflationist Noah Smith who on August 20, wrote Learn to stop worrying and love (moderate) inflation.

The Federal Reserve’s unprecedented programs of Quantitative Easing have not, as many predicted, resulted in substantially increased inflation. But I view this as a failure of the policy, not a success.

[Mish note: unlike other Austrians and countless misguided hyperinflationists, I predicted economic distortions not price inflation]

Popular Inflation Myth 1: “Inflation means I can’t buy as much stuff.”

Wrong. Remember, inflation is an increase in the overall price level. But when the price of everything goes up, your wage should rise as well. Why? Because on average, we are all sellers of something. If you work in a tea shop and the price of tea goes up, your wage can be expected to go up as well, and so forth. Remember, every dollar that one person spends becomes the income of another person!

So when prices go up, wages should go up as well. Read this paper. The authors find that “higher prices lead to higher wage growth”.

Of course, wages are affected by other things besides inflation – for example, labor’s share of total income. So “price inflation” and “wage inflation” aren’t exactly the same. But they tend to be similar:

Not Just Wet, Soaked

Noah’s not just wet, he’s soaked to the bone.

Let’s take a look at Noah’s wage theory vs. practice, starting with Top 1% Received 121% of Income Gains During the Recovery, Bottom 99% Lose .4%; How, Why, Solutions.

Also consider my followup post Reader Asks Me to Prove “Inflation Benefits the Wealthy” (At the Expense of Everyone Else).

Here is the key section.

Real US Household Incomes

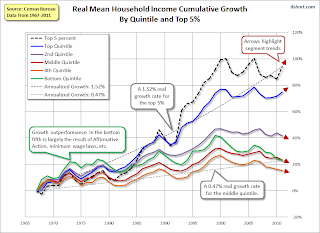

In “real” (CPI-adjusted) terms, 50% of households are no better off than they were in 1988. Let’s dig a litter deeper.Growth in Real Household Income by Quintile

The above chart shows percentage income growth by quintile since 1967. Since 1988, the bottom, 4th and middle quintiles (a combined 60% of households) have negative real income growth. The next chart shows the same thing in a different way.

Real Household Income by Quintile

No matter what your timeframe, only the top quintile did well. And from

1980 until 2000 the top 5% got the lion’s share of income gains.

Reality

While Noah can sit in his ivory tower and express an ill-formed opinion on what should happen, I posted the reality of what did happen – with price inflation every step of the way save a brief period at the bottom of the great recession.

Here is the reality: Those with first access to money, the banks and already wealthy are the only ones who benefit from inflation.

Noah concluded with “We don’t want to let inflation get out of hand. But a higher Fed inflation target for the next decade – say, 4% or 5%, instead of our current 2% – would probably be a good thing for most Americans.”

In essence, Noah proposes a mathematical absurdity: “If it doesn’t work, do 200% more of the same.” The absurdities don’t stop there.

Amazing List of Noah’s Ridiculous Statements

- Inflation Benefit 1: Your debt goes away. Which means that inflation makes you richer. Remember, surprise inflation helps debtors and hurts creditors. Who are debtors? Mostly the young and the poor. Who are creditors? Mostly the old and the rich. Now you hopefully see why many conservatives don’t like inflation!

- Inflation Benefit 2: The federal government debt goes away. That high inflation in the postwar era is exactly how we got rid of our huge World War 2 debt.

- Inflation Benefit 3 (?): “Balance sheet recession” might go away!

Inflation benefits conservatives!?

Inflation, as I have shown, benefits those with first access to money, typically the banks and already wealthy (most likely not the blazing liberals).

Inflation makes you richer!?

That statement by Noah is so ridiculously absurd that only a complete fool could believe it. The housing bubble proves otherwise, so does the dotcom bubble, so does common sense, and so does Hello Noah, Meet Stephanie.

Federal Debt Goes Away With Inflation!?

What about interest on the national debt? What about demographics? WWII debt did not go away because of inflation. In fact, it never went away at all. To the extent it was reduced, it was because of the tide of boomer demographics and the fact that unlike Europe and Japan, the US did not lose productive capacity in WWII.

“Balance sheet recession” might go away!?

We have a balance sheet recession precisely because of an inflationary asset bubble gone bust.

Reflections on Kindness

Caroline Baum was far too kind with her rebuttal, concluding with a simple message “Bad ideas never die. … That won’t stop academics, who are enthralled with an idea that looks good on paper.”

The suggestions of Noah, Mankiw, Blanchard, Rogoff go far beyond “bad ideas”. These guys are economic illiterates living in some alternate universe, where lack of common sense is the norm and lessons of history nonexistent.

Here’s a simple question for you: If “Federal government debt goes away in inflation” as Noah states, then why the hell do we have any? Indeed, with near-constant inflation, why is there any debt at all?

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com