The payroll report tomorrow is going to be interesting. The discrepancy between what Gallup reports and the BLS reports is widening.

Last month, the BLS reported the seasonally-adjusted unemployment rate at 7.4%.

Today Gallup reported Unadjusted unemployment climbs to 8.7% (The seasonally adjusted rate is 8.6%).

Even if there is a huge jump of half a percentage point in unemployment, there will still be a major difference of opinion as to what the rate is.

Here are some charts and discussion from the Gallup report.

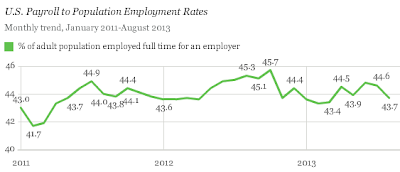

The U.S. Payroll to Population employment rate (P2P), as measured by Gallup, dropped to 43.7% in August, from 44.6% in July, and is down from 45.3% in August 2012.

Gallup’s P2P metric estimates the percentage of the U.S. adult population aged 18 and older who are employed full time by an employer for at least 30 hours per week. P2P is not seasonally adjusted.

August marks the seventh month this year that the P2P rate failed to improve over the same month in 2012. In fact, so far this year, P2P has declined an average of 0.3 percentage points in terms of monthly year-over-year changes. That is a reversal from last year, when 11 out of 12 months showed year-over-year increases in P2P and there was an average 0.8-point increase for the year.

Unemployment Rises to 8.7% in August

Gallup’s unadjusted unemployment rate for the U.S. workforce was 8.7% in August, up from 7.8% in July and from 8.1% in August 2012. Similar to P2P, unemployment fluctuates seasonally, and the year-over-year change is the most informative comparison. The uptick in unemployment this August compared with August of last year is the first year-over-year increase since Gallup was able to begin tracking yearly changes in 2011.

The increase is partly due to the decline in the size of the workforce. Because the unemployment rate is based on the size of the workforce, if people drop out of the workforce but the number of unemployed remains relatively flat, the unemployment rate will actually increase, even though the same number of people are unemployed.

Gallup’s seasonally adjusted U.S. unemployment rate for August was 8.6%, up from 7.4% in July. Gallup calculates this rate by applying the adjustment factor the government used for the same month in the previous year. Last year, the government adjusted August’s rate down by 0.1 points, but adjusted July’s down by 0.4 points, which partly accounts for the increase in seasonally adjusted unemployment.

Underemployment 17.4%

Underemployment, as measured without seasonal adjustment, was 17.4% in August, essentially unchanged from July (17.3%), but up slightly over August 2012 (17.1%).

Gallup’s U.S. underemployment rate combines the percentage of adults in the workforce who are unemployed with the percentage of those who are working part time but looking for full-time work.

Bottom Line

Gallup’s seasonally adjusted U.S. unemployment rate — the closest comparison it has to the official numbers released by the BLS — increased in August. The BLS is not likely to report a decrease in unemployment when the numbers are released on Friday, and may even report a slight increase.

However, it is important to note that Gallup’s adjusted number is based on past seasonal adjustments made by the BLS, and that this year’s BLS adjustments may not be the same when the government releases its number. Additionally, while both Gallup and BLS numbers are based on robust surveys, there are important methodological differences between the two. Thus, although Gallup’s employment numbers are highly correlated with BLS rates, Gallup’s numbers tend to have more month-to-month variability, and the unemployment rate as reported by the BLS each month does not always track precisely with the Gallup estimate.

The decline in the workforce, combined with the drop in P2P and increase in unemployment, indicates that little job growth occurred last month over August 2012. Unemployment rates, which are based on the workforce, can actually decline if unemployed people become frustrated with the job search and drop out of the workforce. This decline in unemployment masks a lack of job growth, and makes the employment situation appear to be improving when in fact little has changed. Many economists have attributed recent improvements in unemployment partly to a shrinking workforce rather than true job growth.

BLS vs. Gallup

- Gallup has the seasonally-adjusted unemployment rate at 8.6%

- The BLS has the seasonally-adjusted unemployment rate at 7.4%

- Gallup has the unadjusted underemployment rate at 17.4%

- The BLS has the unadjusted underemployment rate at 14.3%.

Who To Believe?

Gallup notes seven consecutive months of declining full-time employment. Because of Obamacare effects , the Gallup P2P statistic is entirely believable. The rising trend in unemployment is also believable.

Unless the BLS heavily modifies its August seasonal adjustment factors, I expect the BLS reported unemployment to spike higher over the next two months and for full-time jobs to disappoint as well.

Tomorrow we see, but I am inclined to believe Gallup has this correct regardless of what the BLS reports.

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com