In the previous post, capacity utilization is low and steady, and inflation is too. Low inflation is a sign that labor has a liquidity disadvantage to capital. Explanation below.

Here is inflation (all items less food and energy on a quarterly basis).

Link to graph #1. Quarterly inflation.

Is this a problem? Well… One way to look at inflation is to see it as money growth that was not used for increasing real output. In other words, money is being used to increase employment and production. Money then needs to be distributed among more workers and more production. The result is a suppression in price increases.

So would we rather have increased employment and production or inflation? Increased employment is better. However, the problem is that money growth is not leading the economy. A little inflation would show that money growth is maximizing increases in employment and production. But when we see inflation falling, employment and production could be better with a little more money around.

Where is the money? The real problem is that the money in the hands of labor is not growing. Labor are the primary consumers for finished goods and services. Inflation depends upon money growing faster in the hands of consumers than growth in production.

If there is $100 of disposable income, and 10 items to buy, there is $10 available per item. If disposable income rises by 10% and items increase by 5%, there will be $110 of disposable income and 10.5 items to buy. There will be $10.47 available per item. This leads to inflation.

But if disposable income rises by 5% and items increase by 10%, there will be $105 in disposable income and 11 items to buy. There will be $9.55 available to spend per item, instead of the original $10. This is disinflation.

We have an economy where labor’s liquidity for spending is much weaker than capital’s liquidity for increasing production. Thus, we get this low and steady inflation rate, where production is maximizing its control over the liquidity of consumers. Production is controlled in such a way as to keep the liquidity of consumers from getting stronger. Business methods use such powerful analytical tools that they are able to maximize control over consumer spending to increase their own profits and liquidity.

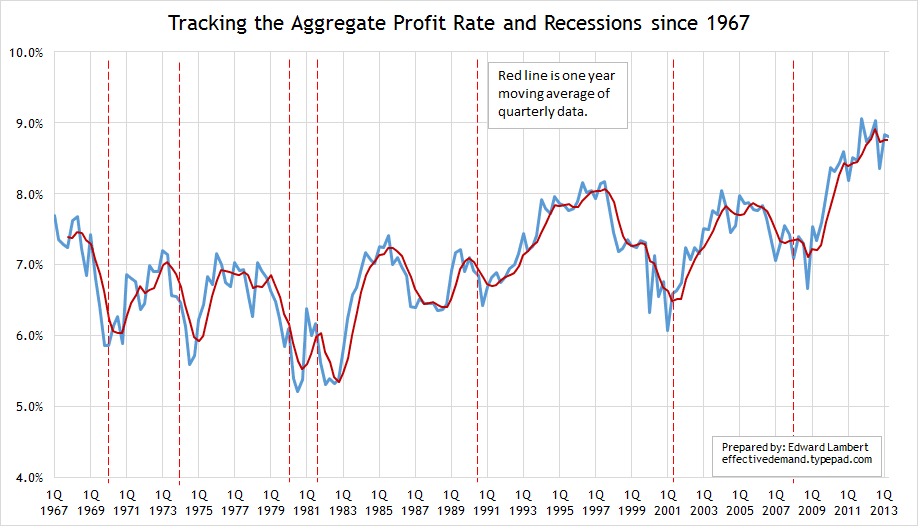

Another problem is that business is also minimizing the cost of labor by keeping wages low. Business, in general, is too focused on increasing profits at the expense of society. The only solution is for labor to increase in power and demand higher wages. Business will simply increase its production and employ more people. That is a good thing, right? Not for business… They are enjoying high profit rates, mostly due to labor share of income falling 5% since the crisis.

Link to graph #2. Aggregate Profit rate since 1967.