S&P/Case-Shiller released the monthly Home Price Indices for October (“October” is a 3 month average of August, September and October prices).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Stage Advance According to the S&P/Case-Shiller Home Price Indices

Data through October 2013, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices … showed that the 10-City and 20-City Composites posted year-over-year gains of 13.6%. This is their highest gain since February 2006 and marks the seventeenth consecutive month that both Composites increased on an annual basis.

In October 2013, the two Composites showed a small gain of 0.2% for the month. Eighteen cities posted lower monthly rates in October than in September. After 19 months of gains, San Francisco showed a slightly negative return. Phoenix held onto its streak and posted its 25th consecutive increase.

“Home prices increased again in October,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “Both Composites’ annual returns have been in double-digit territory since March 2013 and increasing; now up 13.6% in the year ending in October. However, monthly numbers show we are living on borrowed time and the boom is fading.

“The year-over-year figures increased slightly from last month. Thirteen cities and both Composites posted double-digit annual returns. Cities at the top of the range (Las Vegas, San Diego and San Francisco) saw smaller annual increases. On the other hand, cities that have been relatively underperforming (Cleveland, New York and Washington) saw their annual gains grow. Miami showed the most improvement. Chicago recorded its highest annual rate (+10.9%) since December 1988. Charlotte and Dallas posted annual increases of 8.8% and 9.7%, their highest since the inception of their indices in 1987 and 2000.

“The key economic question facing housing is the Fed’s future course to scale back quantitative easing and how this will affect mortgage rates. Other housing data paint a mixed picture suggesting that we may be close to the peak gains in prices. However, other economic data point to somewhat faster growth in the new year. Most forecasts for home prices point to single digit growth in 2014.”

In October 2013, ten cities posted positive monthly returns. Las Vegas showed the largest gain with an increase of 1.2%, followed by Miami with a 1.1% monthly gain. Atlanta, Boston, Chicago, Cleveland, Dallas, Denver, San Francisco, Seattle and Washington were the nine cities that declined month-over-month; two of them, Denver and Dallas, are slightly off their peak set last month. New York remained flat. Only Charlotte and Miami accelerated on a monthly basis.

Click on graph for larger image.

Click on graph for larger image.

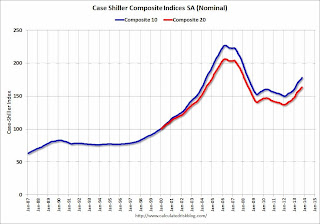

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 21.5% from the peak, and up 1.0% in October (SA). The Composite 10 is up 19.0% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 20.7% from the peak, and up 1.0% (SA) in October. The Composite 20 is up 19.7% from the post-bubble low set in Jan 2012 (SA).

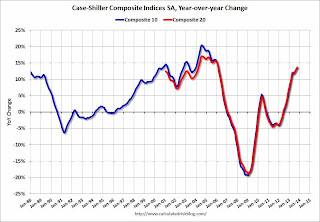

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 SA is up 13.6% compared to October 2012.

The Composite 20 SA is up 13.6% compared to October 2012. This was the seventeenth consecutive month with a year-over-year gain.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in October seasonally adjusted. Prices in Las Vegas are off 46.6% from the peak, and prices in Denver and Dallas are at new highs.

This was slightly below the consensus forecast for a 13.7% YoY increase. I’ll have more on prices later.