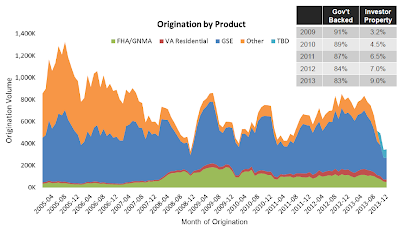

Here are some bullet points from the latest Black Knight Financial Services (formerly LPS Mortgage Monitor) release on 3/4/2014.

- Loan originations declined to the lowest point since Nov. 2008 (down 60% Y/Y)

- Property sales remained relatively strong (total year 2013 was up 8.4% from 2012), supported by increased cash purchases (which accounted for more than 40% of Q4 sales)

- HARP origination volume has declined significantly (down 70% Y/Y), with fewer existing loans now eligible for the program: approx. 709K vs. 2.3M in Jan. 2013

- Home equity lending in 2013 was up 26% vs. 2012, but it’s still down over 90% from 2006

- HELOC performance in recent vintages is pristine (delinquency rates on HELOCs originated over the past 4 years have averaged just 0.1%), but new problem loan rates continue to rise for older lines that have begun to amortize (up 27% Y/Y)

“In January, we saw origination volume continue to decline to its lowest point since 2008, with prepayment speeds pointing to further drops in refinance-related originations,” said Herb Blecher, senior vice president of Black Knight Financial Services’ Data & Analytics division. “Overall originations were down almost 60 percent year-over-year, with HARP volumes (according to the most recent FHFA report) down 70 percent over the same period.

These declines are largely tied to the increased mortgage interest rate environment, which is having a significant impact on the number of borrowers with incentive to refinance. A high-level view of this refinancible population shows a decline of about 13 percent just over the last two months.

“Of course, in addition to higher interest rates, a good deal of this decline can be attributed to the fact that a majority of those who could refinance at historically low rates in recent years already have, and we see a similar dynamic in terms of HARP-eligible loans. The volume of HARP refinances over the past year has driven this population down to about 700,000 loans in January 2014, as compared to over 2.3 million at the same time last year. From a geographic perspective, outside of Florida and Nevada, we see the Midwestern states of Illinois, Michigan, Missouri and Ohio have among the highest percentage of HARP eligibility.”

However, while loan origination volume has declined year-over-year, property sales activity remained relatively strong through year-end 2013, with December’s monthly sales up 3.7 percent year-over-year and full year 2013 up 8.4 percent vs. 2012. Fourth-quarter sales were bolstered by a jump in the percentage of cash sales, to over 40 percent of the total, up from about 25 percent in the prior year.

Origination Volume Lowest Since 2008 with Further Declines Expected

Cash Purchases Have Been Supporting Overall Property Sales

“Refinancible” Portion of the Market Continues to Decline

Number of Loans Eligible for HARP Under Current Standards has Dropped Significantly

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com