EDIT: Ooops. The FHA data is for a year ago.

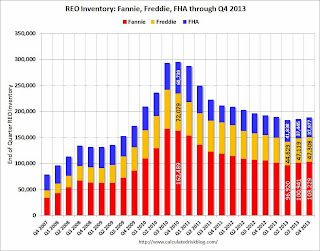

In their Q4 SEC filing, Fannie reported their Real Estate Owned (REO) increased to 103,229 single family properties, up from 100,941 at the end of Q3.

Freddie reported their REO increased to 47,308 in Q4, up from 44,623 at the end of Q3.

The FHA reported their REO increased to 37,977 in Q4, up from 37,445 in Q3. (EDIT: wrong year)

The combined Real Estate Owned (REO) for Fannie, Freddie and the FHA increased to 188,514, up from 185,505 at the end of Q3 2013. The peak for the combined REO of the F’s was 295,307 in Q4 2010.

This following graph shows the REO inventory for Fannie, Freddie and the FHA.

Click on graph for larger image.

Click on graph for larger image.

This is only a portion of the total REO. There is also REO for private-label MBS, FDIC-insured institutions (declined in Q4), VA and more. REO has been declining for those categories.

Although REO is down slightly from Q4 2012, REO has increased for two consecutive quarters – and is still at a high level.

EDIT: Incorrect FHA data.