This will be a light week for economic data.

3:00 PM: Consumer Credit for February from the Federal Reserve.

7:30 AM ET: NFIB Small Business Optimism Index for March.

10:00 AM: Job Openings and Labor Turnover Survey for February from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for February from the BLS.

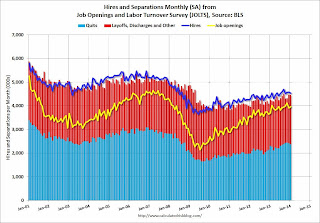

This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of job openings (yellow) were up 7.6% year-over-year compared to January 2013, and Quits decreased in January and were up about 3% year-over-year.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for February. The consensus is for a 0.5% increase in inventories.

2:00 PM: FOMC Minutes for the Meeting of March 18-19, 2014.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 320 thousand from 326 thousand.

Early: Trulia Price Rent Monitors for March. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

2:00 PM ET: The Monthly Treasury Budget Statement for March.

8:30 AM: The Producer Price Index for March from the BLS. The consensus is for a 0.1% increase in prices.

9:55 AM: Reuter’s/University of Michigan’s Consumer sentiment index (preliminary for April). The consensus is for a reading of 81.0, up from 80.0 in March.