Has anyone noticed the slow decay in the US dollar? If not, here it is in pictures.

US Dollar Index Weekly Chart

click on chart for sharper image

As shown above, the US dollar slid from 85 to 79 since July 2013. Looking back a bit further, the US dollar has been range-bound between 89 and 72 since April of 2010

A monthly chart shows the dollar has been range-bound between 71 and 89 since 2008. Going back even further, the dollar has has been range-bound between 92 and 71 since 2004.

Thus, there is nothing unusual about the dollar index at 79 where it sit now, except for the silence and other peculiarities.

Silence is Telling

Typically, every time the dollar declines, dollar bears and hyperinflationists come out of the woodwork chanting the death of the dollar.

Today I hear curious silence. And that’s not all.

Consensus opinion says the Fed will continue tapering then start hiking. In theory, that should be dollar supportive. But it hasn’t been.

Market reaction to the jobs report last Friday was also curious. +288,000 jobs should have been dollar supportive. It wasn’t. Of course, the internals of the jobs report were horrific (see Nonfarm Payrolls +288,000, Unemployment Rate Drops to 6.3%; Household Survey Employment -73,000, Labor Force -806,000) but there was not even an initial reaction.

Mario Draghi and the ECB have been talking about QE and negative interest rates in Europe. In theory, that should be euro negative, thus dollar positive. It hasn’t been.

Why? Perhaps the market thinks the ECB is all talk and no action.

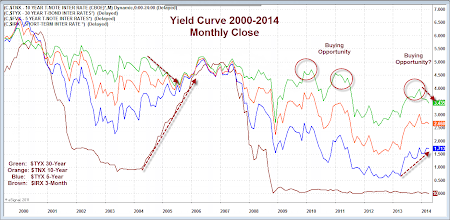

Here is a chart that I commented on at the Wine Country Conference.

Yield Curve Since 2000

Consensus opinion says the economy is getting stronger. The Fed relays that message as well.

But if the economy was getting stronger, then why is the yield on the long bond sinking?

The 30-year long bond yield is currently 3.38% down from 3.95% at the beginning of the year.

Reflections on Beliefs

A friend of mine who is no longer with us, had a saying that crossed my mind while contemplating the above charts: “If the market doesn’t believe it, why should I?“

- In this case, the treasury market acts more like a recession is on the way than the recovery will strengthen.

- The dollar acts acts if the Fed will not hike as quickly as people think.

I believe the treasury and currency markets have this correct. In other words, those markets do not not believe consensus opinions. And if consensus opinion is wrong, treasury bears (at the long end), and dollar bulls in general may wish to reconsider the implications.

Motto to Live By?

Does that make “If the market doesn’t believe it, why should I?” a motto to live by?

Careful!

The answer is “it depends”. Do you really want to buy the S&P here just because it looks like it will not go down?

Certainly, if you are a day-trader, your only concern is what the market thinks at the present. Nothing else matters.

However, it’s not a good motto to live by for a value trader with a long-term horizon. Value traders living by that rule would eventually be doing some rather curious things like buying into market tops.

Know and Trade Your Time Horizon

Day traders get into serious trouble when trades become investments.

Conversely, value investors get into trouble when they start mo-mo trading because everyone else is buying the dip and winning.

Recent capitulation of prior permabears-turned-bulls shows some investors have thrown in the towel. History suggests it’s not likely to end well for those changing styles or major beliefs now.

By the way, Pater Tenebrarum at Acting Man pinged me with this thought yesterday: “There was an 84% bullish consensus on the dollar in the Merrill fund manager survey in July. Such extremes in currency sentiment tend to lead to moves in the opposite direction that can last up to a decade.”

Fundamentally, I see no reason to be bullish on the dollar now, unless one really believes the Fed will taper-to-zero then hike. Since I don’t, the fundamentals and the technical action are in alignment.

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com