Paul Krugman wrote over the weekend…

“Oh, and a word on Sweden, where the central bank is indeed on the edge of deflation but say never mind because output is currently growing. Um, does the bank have an inflation target or doesn’t it? Yes, the economy can expand some of the time even if inflation is below target — but because the inflation rate is low, there isn’t as much room to respond to adverse shocks. So missing the target is a policy failure whatever the current output indicators.”

I want to analyze this situation in Sweden using the Fisher Effect, which would have us look at real output growth and projected natural inflation in order to give us the projected central bank rate . (Output growth gives us the projected natural real rate.) Graphs obtained from tradingeconomics.com.

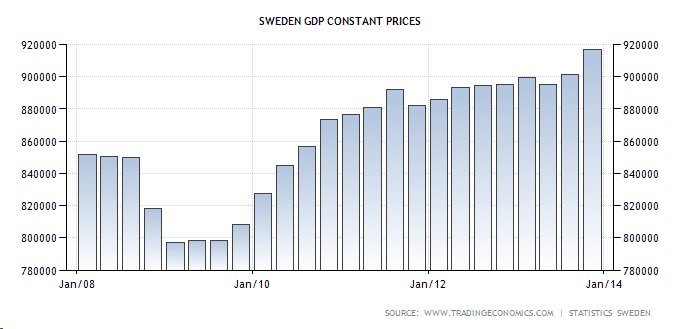

Real output is growing mildly, but it is positive. I roughly assume that real output is growing by 1% per year. Then how about their core inflation rate?

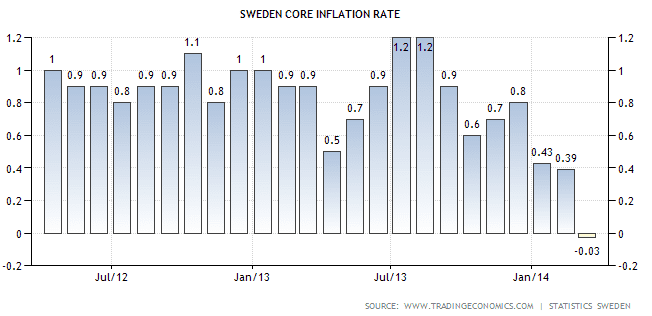

Yes, core inflation ticked into deflation for a month, but I will conservtively assume that core inflation in Sweden could level out at 0.2%. They don’t necessarily have to go into deflation.

Now, how about the central bank rate?

Sweden’s central bank rate is below 1%. However, people think that it will rise some as the economy gets closer to full employment. Using the equation of the Fisher Effect, we can estimate what their future central bank rate is projected to be in the aggregate. I say in the aggregate because some think less, and some think more.

Natural inflation + natural real rate = Projected central bank rate

0.2% + 1.0% = 1.2%

So a 1.2% central bank rate would be roughly projected for their economy. They are not seeing much rise in the central bank rate over where it sits currently.

If Sweden does go into deflation, then people are thinking in the aggregate that the central bank nominal rate will stay below the 1% natural real rate as the economy reaches full employment.