Guest post by Bruce Carman.

He first comments on an article from Jeremy Grantham who says that a coming bubble is likely.

“. . . There are massive reserves of labor in the official unemployment plus room for perhaps a 2% increase in labor participation rates as discouraged workers potentially get drawn into the workforce by steady growth in the economy. There is also lots of room for a pick-up in capital spending that has been uniquely low in this recovery, and I use the word ‘uniquely’ in its old-fashioned sense, for such a slow recovery in capital spending has never, ever occurred before.

“. . . I would be licking my lips at an economy that seems to have enough slack to keep going for a few years.”

(Now Bruce Carman writes…)

I suspect that Grantham does not understand the implications of effective demand. He assumes much more slack in the economy than there likely is.

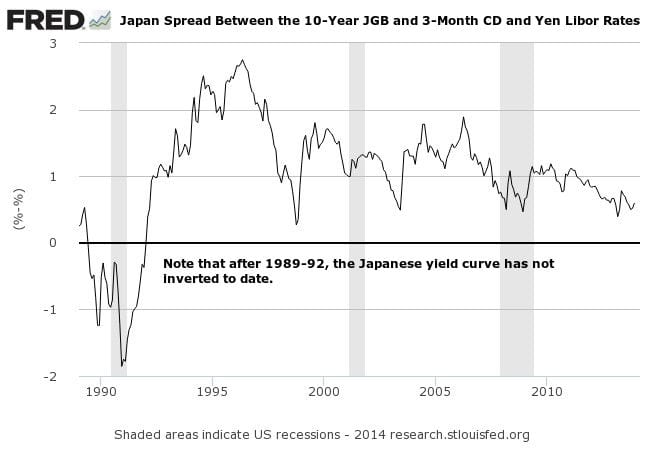

I infer that he also assumes that the economy won’t experience the risk of recession until after the Fed raises rates and the yield curve inverts. But the yield curve does not invert before recessions and bear markets during debt-deflationary regimes, as in the 1830s-40s, 1880s-90s, 1930s-40s, Japan since 1998, and the US and most of the rest of the world in 2008 to date. Japan has experienced 4 bear markets and 3 recessions since the country’s yield curve last inverted in 1992. The US experienced a similar pattern from 1931 to the early to mid-1950s.

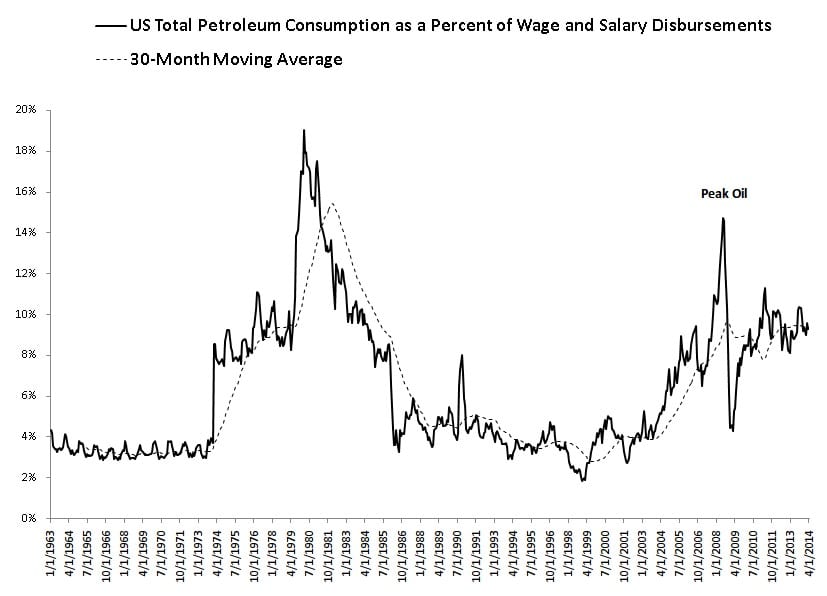

Moreover, the price of oil has accelerated YTD, yoy, and q-q annualized, resulting in CPI accelerating from 1.5% at the end of 2013 to 2.5% YTD and 3.8% q-q annualized for Q2, accelerating to a rate faster than yoy and annualized nominal GDP and reducing q-q annualized real income and wages for Q2 to ~0%. Therefore, we are experiencing a mini-oil shock (by duration so far) to an economy at a much slower secular trend rate of growth, risking no real growth or recessionary conditions most economists do not perceive (not publicly, in any case).

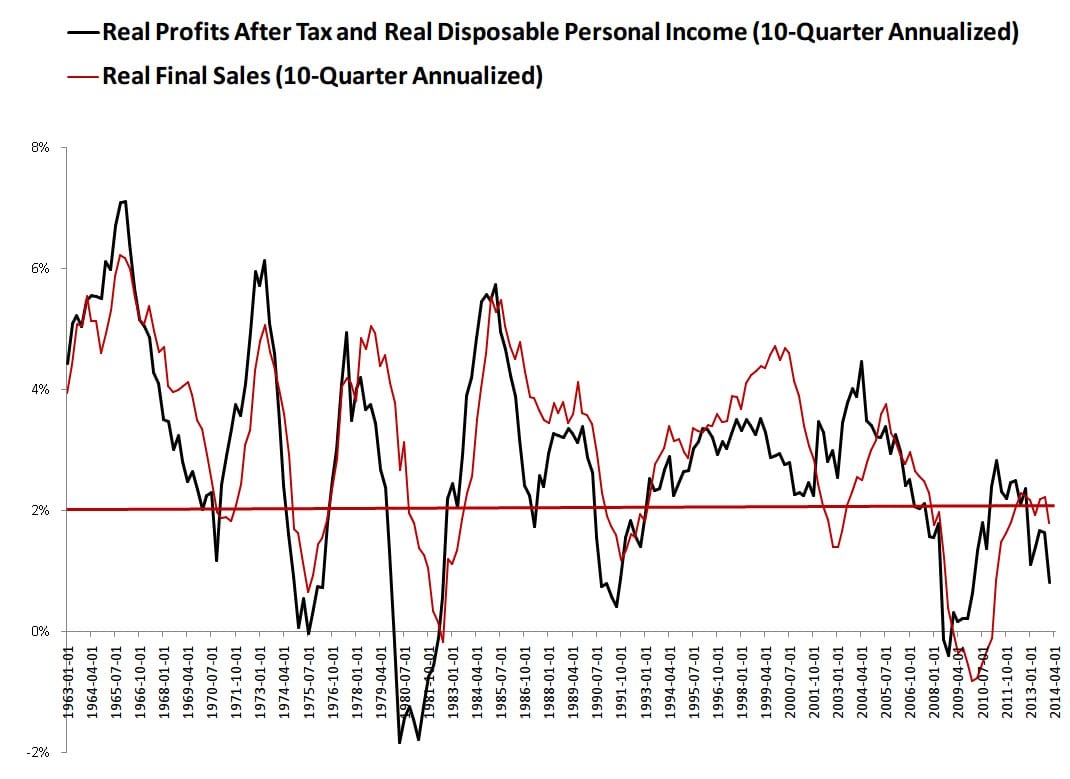

With the secular trend rate of real final sales per capita since 2000 and 2007 having decelerated from 2% to 0.8%, the US economy is much more vulnerable than otherwise to weather, energy, fiscal, and geopolitical shocks that cause periodic or consecutive q-q annualized contractions as occurred in Q1.

Thus, it appears that at the slow trend rate of real final sales/GDP, the US economy cannot withstand an acceleration of price inflation beyond 1.5-2% without stall speed or contraction. This is occurring in the context of the Fed implicitly targeting a 2% inflation rate, whereas some economists propose the wildly misguided policy of the Fed targeting 4-6% inflation to reduce the real interest rate burden from debt service. This would further obliterate real purchasing power of earned income for the bottom 90%.

As of the latest data releases for Q2, I have real final sales/GDP in the 2.1-2.5% range q-q annualized for Q2, which is 1.5% yoy, 0.8% yoy per capita, no growth or a slight contraction YTD, and no growth for 3 quarters running for real final sales per capita. This cyclical pattern of deceleration is historically recessionary.