The most important number in the NAR report each month is inventory. This morning the NAR reported that inventory was up 6.5% year-over-year in June. This is a smaller increase than other sources suggest (Housing Tracker shows inventory up 15% year-over-year in July), and it is important to note that the NAR inventory data is “noisy” and difficult to forecast based on other data.

The headline NAR inventory number is not seasonally adjusted, even though there is a clear seasonal pattern. Trulia chief economist Jed Kolko has sent me the seasonally adjusted inventory. NOTE: The NAR does provide a seasonally adjusted months-of-supply, although that is in the supplemental data.

Click on graph for larger image.

Click on graph for larger image.

This shows that inventory bottomed in January 2013 (on a seasonally adjusted basis), and inventory is now up about 10.9% from the bottom. On a seasonally adjusted basis, inventory was up 1.8% in June compared to May.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, many “contingent short sales” are not included. “Contingent short sales” are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time – they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no “short sale contingent” listings in 2005. In the areas I track, the number of “short sale contingent” listings is also down sharply year-over-year.

Another key point: The NAR reported total sales were down 2.3% from June 2013, but normal equity sales were probably up from June 2013, and distressed sales down sharply. The NAR reported that 11% of sales were distressed in May (from a survey that is far from perfect):

Distressed homes – foreclosures and short sales – accounted for 11 percent of June sales, down from 15 percent in June 2013. Eight percent of June sales were foreclosures and 3 percent were short sales.

Last year in June the NAR reported that 15% of sales were distressed sales.

A rough estimate: Sales in June 2013 were reported at 5.16 million SAAR with 15% distressed. That gives 774 thousand distressed (annual rate), and 4.39 million equity / non-distressed. In June 2014, sales were 5.04 million SAAR, with 11% distressed. That gives 554 thousand distressed – a decline of 28% from June 2013 – and 4.49 million equity. Although this survey isn’t perfect, this suggests distressed sales were down sharply – and normal sales up slightly (even with less investor buying).

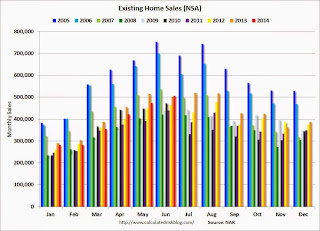

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.

Sales NSA in June (red column) were slightly above the level of sales in June 2013, and above sales for 2008 through 2012.

Overall this report was a solid report.

Earlier:

• Existing Home Sales in June: 5.04 million SAAR, Inventory up 6.5% Year-over-year