For me, the most pressing of matters is the fate that awaits BAS. This may seems odd, but even after cutting its position sizing from almost 25% of my portfolio down to 10% in August, this singular company has had almost comic effect on my positions. The 5% or so in purchases I made throughout its decline can hardly be called the tipping point, as the source of my fate has been without a doubt the move BAS made from $29 to $6.

It is almost idiotic to speak of. Am I blind to something the rest of the market clearly spots? I am human, after all. Barely. But I am human.

So I decided to go take a walk down memory lane, to the dark days of 2010. It was a horrible time, following the worst recession the US had witnessed in almost 100 years. Oil prices had fallen from $140 to (for a few short months) the $30’s.

I believed that looking at these two companies, the BAS of 2010 and the BAS of today, I might learn something. Can BAS survive this oil price rout? Am I even now venturing down the path of my own demise?

I will let you decide.

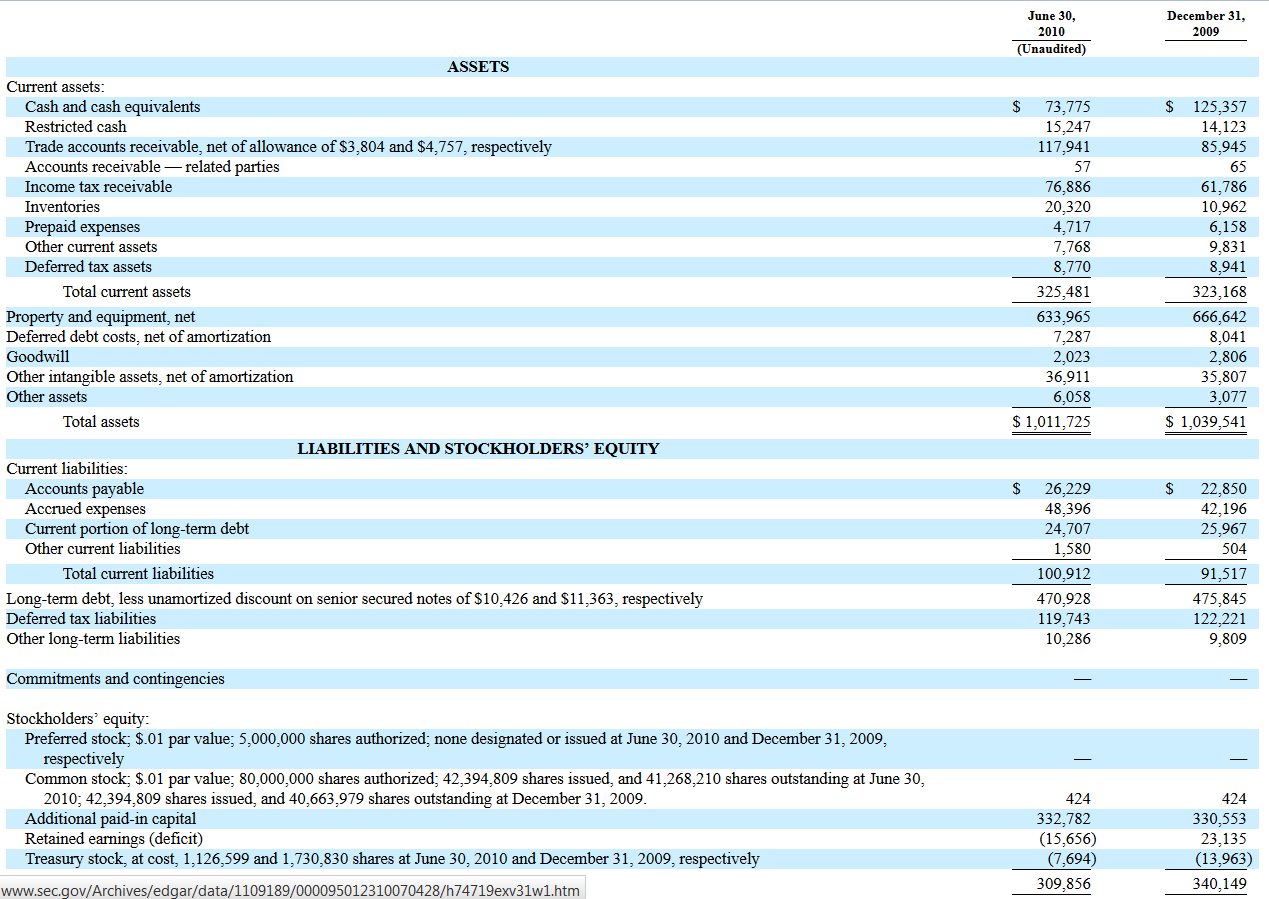

Here is BAS’ balance sheet in June of 2010 (when oil was trading comparably to where it is today).

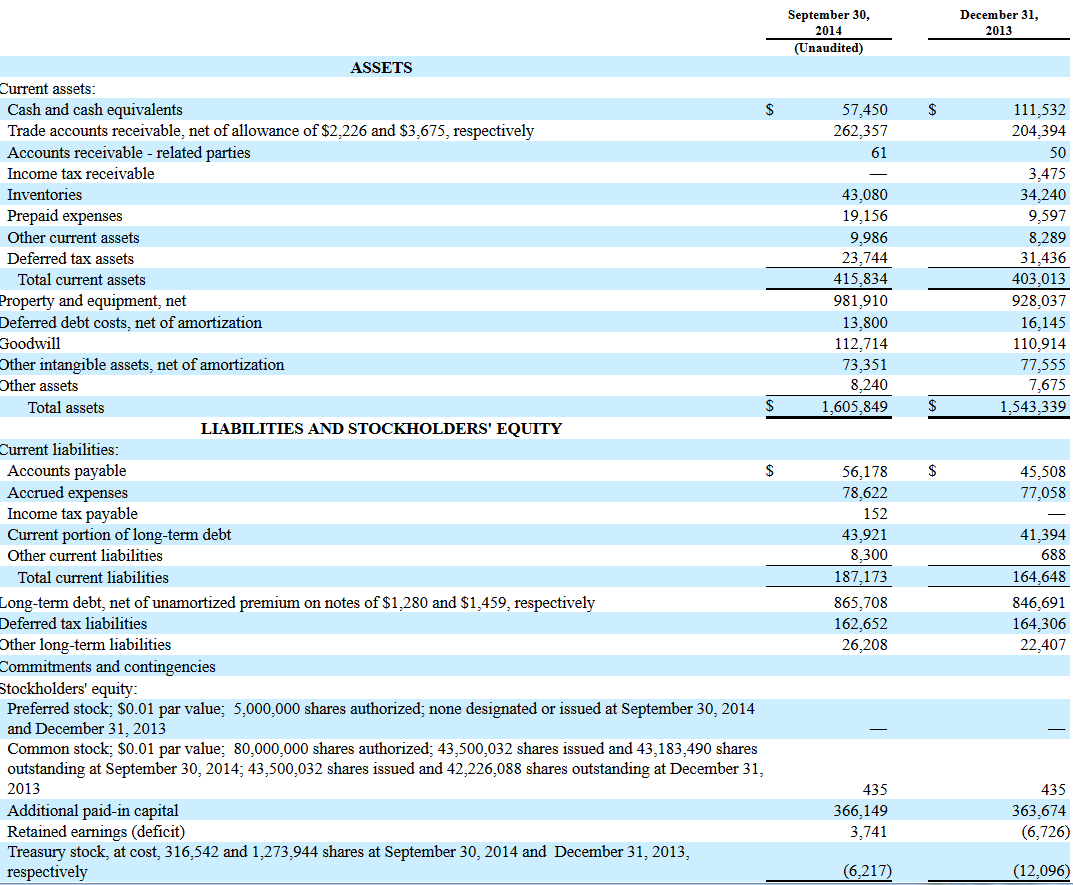

And this is BAS’ balance sheet as of their most recent filing.

Go then, Slavs. Pass your judgment, if you dare. Argue that these are somehow different companies.