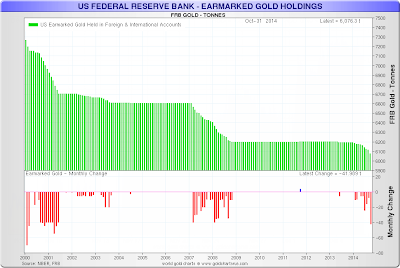

Nick at Sharelynx Gold, also known as Gold Charts “R” Us emailed an interesting chart last week showing gold drain at the New York Fed.

Earmarked Gold drops 42 tonnes for the month of October as foreign countries repatriate their gold home.

click on chart for sharper image or click on preceding link

Gold Charts “R” Us has 1,000’s of pages and over 10,000 charts on a subscription basis, but you can check out the site for free until December 14. Give first link at the top a look and check it out.

Where’s the Gold Going?

This was the largest monthly drawdown in 13 years and the largest series of drawdowns since 2007 (see monthly drawdowns in red on above chart).

So, where’s the gold going? I have three answers.

Germany

Koos Jansen at BullionStar reports German Gold Repatriation Accelerating.

That article is interesting because it takes to task extremely sloppy Bloomberg reporting regarding German golf repatriation.

Netherlands

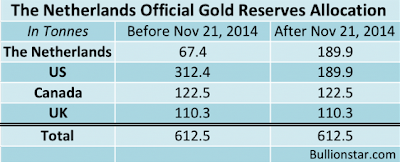

On November 21, Jansen reported Netherlands Has Repatriated 122.5t Gold From US.

The Dutch central bank, De Nederlandsche Bank (DNB), has repatriated in utmost secret 122.5 tonnes of gold from the Federal Reserve Bank of New York (FRBNY) to its vaults in Amsterdam, The Netherlands, according to a press release from DNB published today (November 21).

DNB states it has changed allocation policy from 11 % in Amsterdam, 51 % at the FRBNY, 20 % in Canada and 18 % at the Bank Of England (BOE); to 31 % in Amsterdam, 31 % at the FRBNY, 20 % in Canada and 18 % at the BOE. According to the World Gold Council’s latest data DNB has 612.5 tonnes in official gold reserves.

Belgium

Yesterday Jansen reported Belgium Investigating To Repatriate All Gold Reserves.

Countries want their gold back. Who can blame them?

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com