Spain’s regional and local governments are struggling to pay back debts. The central government has not made much progress either.

El Economista reports 72% of Treasury Issuance in 2015 to Refinance CCAA and Municipalities.

Of estimated €55 billion debt increase for 2015, 72 percent of that amount will be to regional governments and municipalities through new mechanisms created to ease the burden of regional debt and also provide liquidity to local authorities for other policies (through the Fund Management, targeting the most indebted and Economic Promotion Fund for sustainable investments).

The €55 billion debt increase announced Friday is the same as last year, but is €8 billion superior to that which was announced last September.

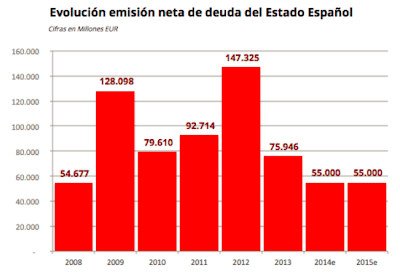

Debt Increase Year by Year

Guru Huky has some interesting charts in his post Spain will Increase National Debt by €55 Billion.

Since 2008, Spanish debt has increased by €600 billion.

Guru notes “Since 2012 we had a tax increase that completely screwed the middle class of this country. And yet we continue with a cruising speed of new debt generation of more than €50 billion a year.”

Interest Rate Perspective

click on chart for sharper image

In spite of the fact that yield on the 10-year government bond is a record low 1.67%, Spain tacks on more debt year after year.

For comparison purposes, the yield on 10-Year US notes is 2.25%.

Like Japan, Europe cannot stand higher interest rates.

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com