The durable goods report for February was released today. It was another disaster in a long line of weak economic reports. And once again economists missed their optimistic estimates by a mile.

Apparently the weather has been bad for six straight months because this is the sixth consecutive decline in overall business spending.

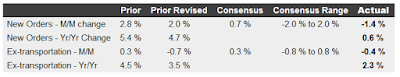

The Bloomberg Consensus Estimate was for a 0.7% rise. The actual number was a 1.4% decline.

Durables orders fell 1.4 percent in February after rebounding 2.0 percent the month before. Market expectations were for a 0.7 percent gain.

Excluding transportation, the core declined 0.4 percent, following a 0.7 percent drop in January. Analysts projected a 0.3 percent gain in February.

With those estimates in hand, let’s dive into the Commerce Report on durable goods.

Durable Goods Synopsis

New Orders. New orders for manufactured durable goods in February decreased $3.2 billion or 1.4 percent to $231.3 billion, the U.S. Census Bureau announced today. This decrease, down three of the last four months, followed a 2.0 percent January increase. Excluding transportation, new orders decreased 0.4 percent [the fifth straight decline]. Excluding defense, new orders decreased 1.0 percent. Transportation equipment, also down three of the last four months, led the decrease, $2.5 billion or 3.5 percent to $69.5 billion. [Orders for nondefense capital goods excluding aircraft dropped 1.4% from January. That marked the sixth straight monthly decline. This is the business spending component for machinery, computers, etc.]

Shipments. Shipments of manufactured durable goods in February, down four of the last five months, decreased $0.5 billion or 0.2 percent to $244.0 billion. This followed a 1.4 percent January decrease. Primary metals, down five consecutive months, led the decrease, $0.3 billion or 1.1 percent to $26.1 billion.

Unfilled Orders. Unfilled orders for manufactured durable goods in February, down three consecutive months, decreased $5.6 billion or 0.5 percent to $1,156.9 billion. This followed a 0.3 percent January decrease. Transportation equipment, also down three consecutive months, led the decrease, $4.6 billion or 0.6 percent to $731.6 billion.

Inventories. Inventories of manufactured durable goods in February, up twenty-two of the last twenty-three months, increased $1.1 billion or 0.3 percent to $413.0 billion. This was at the highest level since the series was first published on a NAICS basis in 1992 and followed a 0.3 percent January increase. Transportation equipment, also up twenty-two of the last twenty-three months, drove the increase, $1.2 billion or 0.9 percent to $135.4 billion.

Capital Goods. Nondefense new orders for capital goods in February decreased $2.1 billion or 2.6 percent to $77.3 billion. Shipments decreased slightly to $80.2 billion. Unfilled orders decreased $2.9 billion or 0.4 percent to $727.8 billion. Inventories increased $0.3 billion or 0.1 percent to $186.8 billion. Defense new orders for capital goods in February increased $0.8 billion or 10.2 percent to $8.3 billion. Shipments decreased $0.1 billion or 0.8 percent to $9.0 billion. Unfilled orders decreased $0.7 billion.

| Item | Feb | Jan | Dec | Jan-Feb %Chg | Dec-Jan % Chg | Nov-Dec % Chg |

|---|---|---|---|---|---|---|

| Total New Orders | 231,291 | 234,462 | 229,827 | -1.4 | 2.0 | -3.7 |

| Ex-Transportation Orders | 161,807 | 162,453 | 163,651 | -0.4 | -0.7 | -0.8 |

| Ex-Defense Orders | 222,596 | 224,795 | 219,755 | -1.0 | 2.3 | -3.2 |

| Transportation Orders | 69,484 | 72,009 | 66,176 | -35 | 8.8 | -10.0 |

| Capital Goods Orders | 86,650 | 86,933 | 81,003 | -1.5 | 7.3 | -10.3 |

| Non-Defense Capital Goods Orders | 77,324 | 79,377 | 72,990 | -2.6 | 8.8 | -10.1 |

| Defense Capital Goods Orders | 8,326 | 7,556 | 8,013 | 10.2 | -5.7 | -11.8 |

| Core Capital Goods Orders | 69,250 | 70,225 | 70,308 | -1.4 | -0.1 | -0.5 |

| Core Capital Goods Shipments | 70,044 | 69,909 | 70,212 | 0.2 | -0.4 | 0.4 |

Line items (except the last line which shows shipments) are new orders, in millions of dollars, seasonally adjusted. Core capital goods exclude defense and aircraft.

Once again this was another exceptionally weak economic report, and once again economists were not close to the mark.

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com