In response to my April 1, post China Margin Debt Soars to Record 1 Trillion Yuan; Another Central Bank Sponsored Bubble I received an email from reader Nicholas.

He writes …

Hello Mish

Happy Monday. I find your output excellent an I hope that you are flattered that you are followed by private banks is Switzerland.

Quick question on your last note; please can you tell me what (Bloomberg/Reuters) code you use for Chinese Margin debt? i.e. where can I cross-reference the Trillion Yuan figure you quote?

Best regards and many many thanks,

Nicolas

I certainly was unaware I was followed by banks in Switzerland. Thanks!

The Bloomberg data is from SSE Margin, in Chinese. I asked my friend Chris Puplava at Financial Sense if he was aware of a Bloomberg tracking symbol. We do not believe there is such a symbol for margin.

However, Chris did locate this interesting chart of the Shanghai stock market vs.new accounts that is available on Bloomberg.

Shanghai Stock Index vs. New Accounts

click on chart for sharper image

I get lots of data from readers, and I appreciate it!In regards to China, reader Norman writes …

Hello Mish,

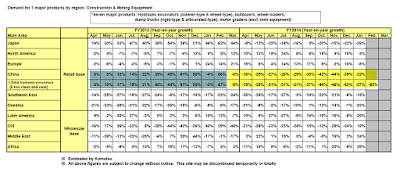

Thanks for your “straight talk” on important issues impacting our financial lives. You recently sent information concerning China’s GDP. A good indicator of growth is found in sales of construction equipment. Construction equipment manufacturer Komatsu lists its equipment orders by location. The numbers speak for themselves concerning growth and China. Keep up the good work!

Norman

Komatsu Orders

click on chart for sharper image

Komatsu is just a single manufacturer. I do not know if it is representative of all such activity and orders. But if it is, (and I suspect it is given the collapse in commodity prices such as iron ore), this segment of the Chinese economy looks like a disaster.

Those expecting a rebound in Chinese housing or construction are likely mistaken. The new game in town is clearly stock market speculation.

Chinese Growth

In case you missed it, please check out Reality Check: How Fast is China Growing? Global Recession at Hand

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com