I have been bearish on China manufacturing and growth in general for years. It is no surprise to me that news is generally negative.

For example, on news today that China’s PMI “unexpectedly” declined Yahoo!Finance reported China Factories Falter, Commodities Take the Hit.

Activity in China’s factory sector seemingly contracted at the fastest pace in 15 months in July, a preliminary private survey showed on Friday in a blow undercutting recent signs of stabilization in the struggling economy.

The drop confounded forecasts for a rise to 49.7, from June’s final reading of 49.4, and slugged the Australian dollar to a six-year low.

“Today, it’s big, bad news with this number well below consensus,” said analyst Helen Lau of Argonaut Securities in Hong Kong. “It shows there’s no signs of recovery in small and mid-sized business in China, but I think it’s also related to the summer weak season for demand.”

China Rehash

In a complete rehash of the above, but under a different title Yahoo!Finance reported one hour later Asian Shares Tumble as Weak China PMI Revives Demand Concerns.

There’s actually less information in the second article than the first.

PMI Report

Let’s go straight to the Markit Report for the results of the latest Flash China General Manufacturing PMI™.

Key Points:

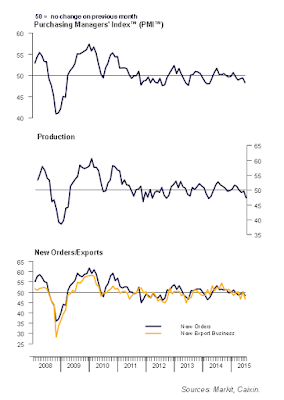

- Flash China General Manufacturing PMI™ at 48.2 in July (49.4 in June). 15-month low.

- Flash China General Manufacturing Output Index at 47.3 in July (49.7 in June). 16-month low.

PMI, Production, New Orders

The above chart shows Chinese manufacturing has been languishing for years. I do not believe, and have not believed Chinese GDP reports for at least as long.

Mainstream media appears to be catching on.

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com