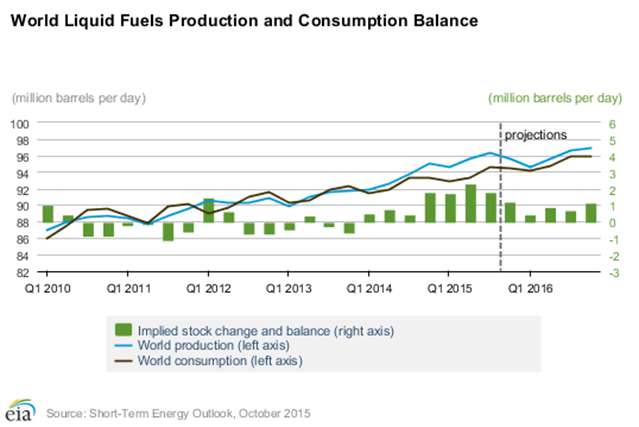

Take a good look, because the oil price weakness is about to come to an end. I am not saying that just because the EIA is predicting the production/consumption balance to close (as predicted by everything to the right of the vertical delineation).

I am saying so because all the big players are starting to make very visible, very vocal moves designed to assure the market that they will get the imbalance under control. The Saudi’s have made some token production cuts, after biting off quite a bit more than they can chew with all of this. Shell has just abandoned the Arctic drilling – a project that, in for $4.5 billion, has been the proverbial chain around Shell’s neck – in the loudest and most attention getting way imaginable. And anyone with a pen is writing about how US Shale production is coming down (despite it not really happening yet).

But look close at the EIA historical chart above and realize how tame the production overrun has been. 2 million barrels a day is not the end all, be all of the oil market. In 2009 alone, just US demand for crude oil plunged 1.1 million barrels per day. Demand from all industrialized nations dropped by something like 2.2 million barrels per day. OPEC by itself had to slash production by 1.5 million barrels per day just to try and shore the market up.

Those were real production cuts responding to real demand destruction. By comparison, what we have here is production that’s gotten a little ahead of demand growth. So far, aside from some hiccups in Europe and China, there’s been no demand destruction to speak of. This is not cause for the end of oil; it’s a case of the need for some very weak, very adventurous hands to get flushed out. And that process is almost over.

And isn’t it interesting that the most adventurous, most weakly positioned oil plays all end up being Big Oil or State owned? Let’s be clear, the most expensive plays on the planet are in deep water or remote locations or involve tedious chemical and refinement processes. If you’re drilling 150 feet below the surface of the Atlantic Ocean, or in the middle of the Arctic circle, I have a feeling you’re not a $2 billion market cap company. You’re probably a Shell, or an Exxon Mobile, or the country of Norway, Russia or Brazil.

The Saudi’s haven’t killed the US oil boom; they’ve killed oil funded State welfare schemes. Including their own, I might add…

I will be the first to admit that I didn’t believe the Saudi’s were trying to get into a production war with the US – wrongly. But I didn’t believe it for a pretty good reason; because this was really, really stupid. The Saudi’s have set their own economy in tatters, and why? Because some new king wanted to claim Saudi Arabia was still the biggest oil exporter? Because this was somehow going to make them richer?

What the Saudi’s have done, effectively, is make it necessary for them to produce twice as much oil for the same amount of money. Who fucking does that?

If oil markets had accepted that $70 oil was the new floor price to extract tar sands or deep water fields, the Saudi fields would have been getting $150 a barrel for their extraction cost of – what is it even? – $20 a barrel? As the price had risen, the need for the Saudi’s to be the biggest producer would have just phased out. They could have gotten by on lower production, preserving their precious low cost oil for decades more.

Instead, they get shit. Their dollar reserves are flying out the door and their zero debt position is soon going to be a distant memory.

Well done, House of Saud. You morons deserve to be thrown from power for that.