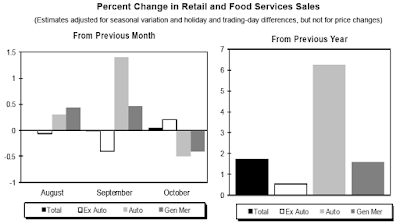

This month the retail sales consensus expectation was for a 0.3% rise.

The actual reading was a gain of just 0.1% for the month. In addition, last month’s retail sales were revised lower to +0.0% from an initial reading of +0.1%.

This was the third consecutive weak report.

Nonetheless Bloomberg managed to put an amazing amount of lipstick on today’s report. Let’s take a look.

Retail sales slowed in October but fundamentally remain solid. Sales rose only 0.1 percent, 2 tenths under the Econoday consensus. But when excluding vehicles, which slipped back after surging in prior months, and when also excluding gasoline stations, where sales once again fell on price weakness, core sales rose a respectable 0.3 percent which hits the consensus.

And there are solid gains including for housing-related components of furniture & home furnishings and building materials & garden equipment. Nonstore retailers also show a strong gain as do restaurants.

Aside from vehicles and gas, other areas that declined are electronics & appliance stores, grocery stores, and the big category of general merchandise sales. Declines in the latter may be related to import-price effects which are deflating sales. A positive, however, is a gain for department stores which are a subset of general merchandise. Apparel sales, which are definitely being held down by import prices, were unchanged following two small declines.

Year-on-year rates really tell the story especially a respectable plus 4.1 percent rate for sales excluding gasoline stations, a component that is down 20.1 percent and has been badly skewing total sales all year. Total sales are up only 1.7 percent.

The headline is weak and year-on-year rates did ease off, including for core ex-auto ex-gas to plus 3.5 from 3.8 percent, but this report is better than it looks, showing underlying strength that shouldn’t scale down expectations for a December FOMC rate hike.

Retail Sales Year-Over-Year

Note that year-over-year retail sales were positive at the start of the last two recessions.

Retail Sales Components

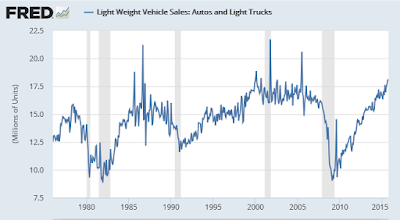

Car Boom Ending?

The closer one looks at the data, the more obvious it is that Bloomberg put a huge amount of lipstick on its synopsis.

For the last three months combined, ex-auto retail sales are down, on average. Auto sales is one component that has propped up retail sales.

Is the decline in auto sales this month just a snap-back from the massive auto surge in September, or is it the end of the boom?

No one can answer this question now, but it should be obvious that car sales cannot boom forever. And when auto sales do turn, retail sales will no longer prop up the economy.

Today’s Producer Price Index report may provide a clue in regards to weakening demand. For details, please see PPI Unexpectedly Declines Second Month; Another Big Decline Likely Next Month.

Mike “Mish” Shedlock