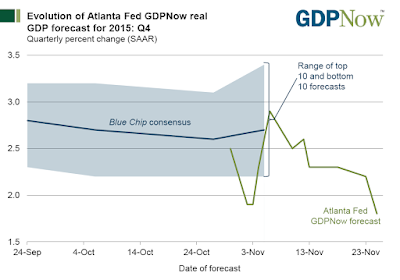

Fourth Quarter GDPNow Forecast Sinks to 1.8%

Following today’s personal income report in which consumer spending rose only 0.1% month-over-month, the Atlanta Fed GDPNow Forecast for fourth quarter declined by 0.5 percent to 1.8 percent.

“The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2015 is 1.8 percent on November 25, down from 2.3 percent on November 18. The forecast for the fourth-quarter rate of real consumer spending declined from 3.1 percent to 2.2 percent after this morning’s personal income and outlays release from the U.S. Bureau of Economic Analysis.“

The latest Blue-Chip forecast for early November was 2.7%, a highly unlikely number at this stage unless season spending picks up big time.

Reports show stores are not discounting merchandise as much as consumers like, and consumers generally expect to spend less, so odds of a hefty jump in Christmas sales is questionable.

We may know more next week when reports on Black and Blue Friday become available.

4th Quarter GDP Trends

Consumer Exhaustion

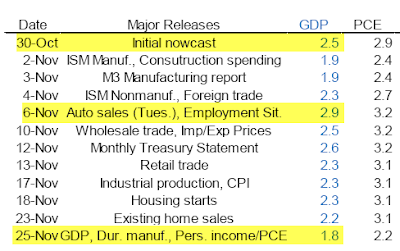

The initial 4th quarter GDPNow forecast started at 2.5% on October 30. It rose as high as 2.9% following the auto sales and jobs reports. It’s pretty much been downhill since then.

Wholesale trade, retail trade, existing home sales, all knocked off points.

Today’s Personal Incomes and Outlays Report knocked off a half percentage point even though wage growth was substantial.

Many signs point to consumer exhaustion.

Back-to-school spending was weak, housing starts have been weak, existing home sales are weak, manufacturing has been weak, recent spending reports have been weak, and Christmas sales appear “tepid” at this point.

Auto sales have been the one consistently bright spot, in this otherwise treading water economy, but what cannot go on forever, won’t.

Mike “Mish” Shedlock