Empire State Manufacturing Employment and Workweek Worst Since 2009

As expected, the Empire State Manufacturing Index is is contraction for the fifth consecutive month. employment and workweek have collapsed.

Economists pretty much got the index correct with a Consensus Estimate of -7.00 vs. the actual reading of -4.59.

Factory activity continues to contract in the New York manufacturing region and especially, unfortunately, employment and the workweek. The Empire State index posted its fifth negative reading in a row, minus 4.59 for December which however is the least weak reading of the run. New orders, at minus 5.07, are down for a seventh month in a row but here to the degree of contraction is easing. Not easing, however, is employment which is deeply negative at minus 16.16 for the fourth contraction in a row and the deepest since July 2009. The workweek is another disappointment, at minus 27.27 for the worst reading since even further back, to April 2009.

But there are pluses in this report led by a big gain for the six-month outlook, to 38.51 from 20.33. The gain reflects greater optimism for new orders and shipments but no greater optimism for employment where hiring is expected to be no more than moderate.

Turning back to negatives, prices received are down for a fourth month in a row, at minus 4.04. Contraction in prices for finished goods points to price concessions and lack of demand.

The recovery worst readings for employment and the workweek are definitely worrisome signs. Yes, this report has been running lower than other regional manufacturing reports but today’s results do not point to any year-end lift for the factory sector which is being hit by low exports and low prices.

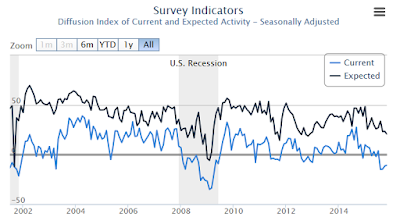

Six-Month Outlook Useless

There were no positives in this report. The six-month outlook is generally useless as I have proven before.

Bottoms tend to form just as everyone throws in the towel. Only following extreme negative sentiment, after everyone gives up, does the future outlook tend to be too pessimistic.

Thus, increasing optimism in the face of these declines might even be worrisome.

Manufacturing Overoptimism

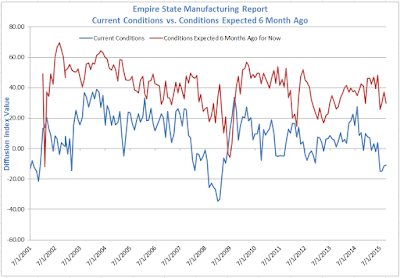

Here is a chart of the Empire State Survey from last month showing expected conditions six month from now.

In the second chart below, I shifted the actual results to show what happened.

Current Business Conditions vs. Expected Conditions Six Month From Now

To see if there is any merit in tracking future projections, I downloaded the data, and shifted the projections ahead by six months to plot current conditions vs. what the manufacturers expected to happen.

Current Business Conditions vs. Expected Business Conditions (For Now – Made Six Month Ago)

Perpetual Overoptimism

The perpetual overoptimism is impossible to miss. Here are the readings for 2015.

| Month/Year | Current Conditions | Expected Conditions |

|---|---|---|

| 1/2015 | 7.78 | 46.10 |

| 2/2015 | 6.90 | 46.08 |

| 3/2015 | -1.19 | 42.39 |

| 4/2015 | 3.09 | 46.84 |

| 5/2015 | -1.98 | 39.31 |

| 6/2015 | 3.86 | 48.35 |

| 7/2015 | -14.92 | 25.58 |

| 8/2015 | -14.67 | 30.72 |

| 9/2015 | -11.36 | 37.06 |

| 10/2015 | -10.74 | 29.81 |

In 167 months, nearly 14 years of data, there were only five months (just under 3% of the time) in which current conditions exceeded projections made six months previous!

| Month/Year | Current Conditions | Expected Conditions |

|---|---|---|

| 2/1/2002 | 13.80 | -11.92 |

| 6/1/2009 | 0.28 | -3.65 |

| 7/1/2009 | 12.56 | -5.55 |

| 8/1/2009 | 20.93 | 3.53 |

| 9/1/2009 | 33.68 | 28.27 |

Persistent Overoptimism Three Ways

For more on overoptimism, pleas see …

- Persistent Overoptimism Three Ways: Truckers, Fed Economists, Manufacturers

- Tracking Manufacturing’s Perpetual Overoptimism

Mike “Mish” Shedlock