Energy-Related Losses Mount

Bank loan loss impairments related to the energy sector are set to rise rapidly.

Banks have made drilling loans to companies that are only profitable at oil prices above $50. And the price of oil just closed under $30 for the first time in about 12 years.

Diving Into Rumors

Zero Hedge has an interesting post on Saturday entitled Dallas Fed Quietly Suspends Energy Mark-To-Market On Default Contagion Fears.

In his post, ZeroHedge claims “The Dallas Fed met with the banks a week ago and effectively suspended mark-to-market on energy debts and as a result no impairments are being written down. Furthermore, as we reported earlier this week, the Fed indicated ‘under the table’ that banks were to work with the energy companies on delivering without a markdown on worry that a backstop, or bail-in, was needed after reviewing loan losses which would exceed the current tier 1 capital tranches.”

Mark-to-Market Accounting History

You cannot suspend what has already been suspended.

On April 3, 2009, the Wall Street Journal reported FASB Eases Mark-to-Market Rules.

Suspension of mark-to-market account was one of the factors that ignited the stock market in Spring of 2009.

Wikipedia has these notes on Mark-to-Market Accounting.

- On September 30, 2008, the SEC and the FASB issued a joint clarification regarding the implementation of fair value accounting in cases where a market is disorderly or inactive. Section 132 of the Emergency Economic Stabilization Act of 2008, which passed on October 3, 2008, restated the SEC’s authority to suspend the application of FAS 157.

- On October 10, 2008, the FASB issued further guidance to provide an example of how to estimate fair value in cases where the market for that asset is not active at a reporting date.

- On December 30, 2008, the SEC issued its report under Sec. 133 and decided not to suspend mark-to-market accounting. [Mish Comment: Markets that rallied into the end of the year, collapsed again in January and February]

- On March 16, 2009, FASB proposed allowing companies to use more leeway in valuing their assets under “mark-to-market” accounting. On April 2, 2009, after a 15-day public comment period and a contentious testimony before the U.S. House Financial Services subcommittee, FASB eased the mark-to-market rules through the release of three FASB Staff Positions (FSPs). Financial institutions are still required by the rules to mark transactions to market prices but more so in a steady market and less so when the market is inactive. To proponents of the rules, this eliminates the unnecessary “positive feedback loop” that can result in a weakened economy. [Mish Comment: Markets took off just ahead of the change and never looked back]

- On April 9, 2009, FASB issued an official update to FAS 157 that eases the mark-to-market rules when the market is unsteady or inactive. Early adopters were allowed to apply the ruling as of March 15, 2009, and the rest as of June 15, 2009. It was anticipated that these changes could significantly increase banks’ statements of earnings and allow them to defer reporting losses.

No Subsequent Mark-to-Market Changes

There have been no subsequent changes. And here we are, back in bubble land, with hidden losses mounting again.

By, how much? Who the hell knows because mark-to-market accounting has already been effectively suspended.

We do have some facts, however.

More Banks Take Energy Hits

The Wall Street Journal reports More Banks Take Hits on Energy Loans.

Months of low oil prices are starting to take a toll on banks. Large U.S. banks reporting earnings Friday said they saw more energy loans go bad in the fourth quarter. Many lenders also added millions of dollars to reserves in anticipation that more oil-and-gas loans will sour.

“It’s starting to spread,” said William Demchak, chief executive of PNC Financial Services Group Inc. on a conference call after the bank’s earnings were announced. Credit issues from low energy prices are affecting “anybody who was in the game as the oil boom started,” he said.

Citigroup Inc. added to its rainy-day reserves for soured loans for the first time since 2009, adding $250 million specifically for energy and $494 million overall. “Obviously there is some pressure in the energy-related markets at this point in time,” John Gerspach, Citigroup’s chief financial officer, said on a conference call Friday.

As many as one-third of American oil-and-gas producers could tip toward bankruptcy and restructuring by mid-2017, according to Wolfe Research. Survival, for some, would be possible if oil rebounded to at least $50 a barrel, many analysts say.

Concerns about oil and gas exposure have battered the stocks of banks with big energy portfolios. Zions Bancorp shares are down 18% since the beginning of the year, while BOK’s are down 20% and Cullen/Frost Bankers Inc. shares are down 22% during that period. The KBW Nasdaq Bank Index is down 13% amid a broad market decline.

Still, banks continue to maintain that any energy losses remain manageable.

Wells Fargo & Co. had $90 million in higher losses in its oil-and-gas portfolio during the fourth quarter, and the bank said it boosted its commercial-loan reserves as a result. Wells Fargo played down the potential impact of the energy problems, noting that oil and gas loans remained around only 2% of its total loans, and that more than 90% of the problem oil-and-gas loans in its portfolio were current on their interest payments as of the end of 2015.

J.P. Morgan Builds Loss Reserves for the First Time in Six Years

On January 14, The Wall Street Journal asked: Turning Point? J.P. Morgan Builds Loss Reserves for the First Time in Six Years

J.P. Morgan Chase & Co. built up its reserves for bad loans, a shift that spotlights Wall Street’s mounting concerns about the fate of oil and gas companies.

J.P. Morgan added $136 million to its loan-loss reserves in the fourth quarter of 2015, according to the bank, or $187 million if provisions for lending-related commitments are included.

The New York bank, the largest in the country by assets, said the bulk of its added reserves, $124 million, were related to its portfolio of loans to oil and gas companies.

But the bank doesn’t expect to drastically reduce its energy lending, Chief Executive James Dimon said on a call with analysts. “If banks just completely pull out of markets every time something gets volatile or scary, you’ll be sinking companies left and right.”

Citigroup Inc. said in December it was likely to add $300 million to $400 million to its reserves, primarily because of low oil prices. Citigroup and Wells Fargo & Co. announce their fourth-quarter earnings Friday, with Bank of America Corp. to follow on Tuesday. Spokesmen for Citigroup and BofA declined to comment. A Wells Fargo spokesman couldn’t immediately be reached.

J.P. Morgan’s move on Thursday was the first time any of the big four U.S. banks has added to its loan-loss reserves since the fourth quarter of 2009.

The buildup was also notable as it indicates the potential end of an era in which “releases” of loan-loss reserves flowed into and offered a welcome boost to banks’ earnings, at a time when the banks often had difficulty generating profits from their operating businesses. Over the past six years, those releases have contributed nearly $25 billion to J.P. Morgan’s pretax income, and about $86 billion to the four banks’ total pretax income.

“You can’t release loan-loss reserves forever,” said Jason Goldberg, an analyst at Barclays PLC. “We’re actually surprised reserve levels got this low.”

Bankruptcies Coming Regardless

ZeroHedge’s initial rumor the “Dallas Fed members had met with banks in Houston and explicitly told them not to force energy bankruptcies and to demand asset sales instead.” could very well be true.

There’s not much shocking in that statement actually.

ZeroHedge concluded “The Dallas Fed, whose new president Robert Steven Kaplan previously worked at Goldman Sachs for 22 years rising to the rank of vice chairman of investment banking, has not responded to our request for a comment as of this writing.“

Regardless of what Kaplan instructed the banks to do, bankruptcies cannot be avoided by selling assets.

Sell what assets? At what price?

The assets in question are rigs, land, and drilling rights. What demand is there for used rigs? And what near-term value do energy properties have at current energy prices?

Oil reserves and the value of those reserves have both collapsed.

Bankruptcies are coming and with them so will loan losses. Either loan loss provisions rise now, or bankruptcies impose unannounced losses in the not so distant future.

Wells Fargo Is Bad, But Citi Is Worse

In an update on Sunday, ZeroHedge posted Wells Fargo Is Bad, But Citi Is Worse.

Earlier we reported that Wells Fargo may have an energy problem because as CFO John Shrewsbury revealed, of the $17 billion in energy exposure, “most of it” was junk rated.

But, while one can speculate what the terminal cumulative losses, cumulative defaults and loss severities on this loan book will be, at least Wells was honest enough to reveal its energy-related loan loss estimate: it was $1.2 billion, or 7% of total – as Mike Mayo pointed out, one of the highest on the street. Whether it is high, or low, is anyone’s guess, but at least Wells disclosed it.

Citi did not.

Note the following perplexing exchange between analyst Mike Mayo and Citi CFO John Gerspach:

Mike Mayo: Can we move to energy, though? I don’t want you being the only bank not disclosing reserves to energy – oil and gas loans. I mean, I think most others have disclosed that who have reported so far. And I mean, your stock’s down 7%. The whole market is down a whole lot, but I don’t – even if it’s a low number, it can’t hurt too much more from here. And so can you – how much in oil and gas loans do you have, and what are the reserves taken against that? I know you were asked this already, but I’m going back for a second try.

John Gerspach: When you take a look at the overall portfolio, Mike, we’ve reduced the amount of exposure. Our funded exposure to energy-related companies this quarter is down 4%. It’s about $20.5 billion. The overall exposure also came down about 4%. The overall exposure now is about $58 billion, that includes unfunded. When you take a look at the composition of the funded portfolio, about 68% of that portfolio would be investment grade. That’s up from the 65% that we would have had at the end of the third quarter. And the unfunded book is about 87% investment grade. So while we are taking what we believe to be the appropriate reserves for that, I’m just not prepared to give you a specific number right now as far as the amount of reserves that we have on that particular book of business. That’s just not something that we’ve traditionally done in the past.

One wonders just how much of Gerspach’s decision was dictated by the Fed’s under the table suggestion to avoid mark to market in energy entirely, and thus to stop marking its loan book.

Finally, we eagerly await for someone from the Dallas Fed to contact us and to comment on our article from yesterday that the “Dallas Fed Quietly Suspends Energy Mark-To-Market On Default Contagion Fears.” Because with megabanks such as Citi refusing to disclose energy losses, the longer the Fed remains mute on just what it knows that nobody else does, the more concerned the market will be that the subprime crisis is quietly playing out under its nose all over again.

Citi Math and a Bit of Realism

Citi refused to provide its loan loss provisions on energy. But it did provide exposure information. Funded exposure is $20.5 billion. 68% of that is investment grade. That makes $6.56 billion junk.

I am not here to defend Citi. I am here to inject a bit of realism.

Losses related to energy, whatever they may be, will be much smaller than losses related to the housing bubble crash.

Let’s explore that idea with a series of charts.

Loan Loss Reserves to Total Loans

Loan loss provisions kept rising in spite of mark-to-market suspension. The market imposed losses, but admission was at a “pace that was measured”.

Loan loss reserves as a percentage of total loans hit a record high 3.70% in first quarter of 2010. Loan losses for the Dallas region peaked in third quarter of 2011 at 2.11%.

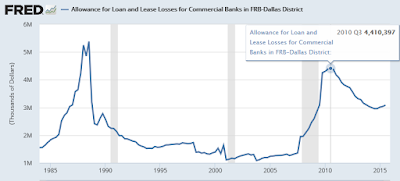

Let’s now investigate loan loss allowances in dollar amounts, starting with the Dallas region.

Allowance for Loans and Lease Losses, Dallas

The allowance for loans an lease losses in the Dallas region peaked at $4.412 billion in the third quarter of 2010. It is currently at $3.08 billion.

Allowance for Loans and Lease Losses, All Commercial Banks

The allowance for loans and lease losses for all commercial banks peaked in April 2010 at $235.8 billion vs. $4.4 billion for the Dallas region alone.

Even if fears over energy-related oil losses are a bit overblown, problems are beginning to mount and it’s highly likely to spill over into many other sectors of the economy.

The consumer is not doing all that well. Home prices are once again well beyond affordable. Manufacturing is in an outright recession. The rest of the economy is poised to follow manufacturing, or already has.

Turning Point

Declining loan loss provisions are net accruals to earning. Rising loan loss provisions are subtractions from earnings.

Between April 2010 and December 2014 loan loss provisions shrank by $126.8 billion, directly padding bank bottom lines.

In 2015, the decline in loan loss provisions was a mere $2.4 billion.

The real story is not the alleged suspension of mark-to-market rules. Rather, the real story is rising loan and lease loss provisions, across numerous segments, not just energy.

I expect loan loss provisions for housing, construction loans, subprime autos, credit cards, malls, and of course energy, will all rise.

This is a significant turning point. Loan and lease losses have only one way to go: Up. How high remains to be seen, but the effect on earnings won’t be pretty.

To top it off, Iran About to Unleash Tidal Wave of Oil Into Depressed Markets.

Mike “Mish” Shedlock