Those expecting a bounce in manufacturing following an alleged improvement in the Philadelphia Region were mistaken.

In Philadelphia, all that really happened was that things got worse at a decreasing rate.

Dallas Region Collapse

The Dallas Fed General Activity Index plunged to -34.6 from a revised reading last month of -20.1. The Econoday Consensus Estimate was -14.0 in a range of -17.0 to -10.0. The production index, also plunged. Last month the index was in positive territory at 12/7. It’s now -10.2.

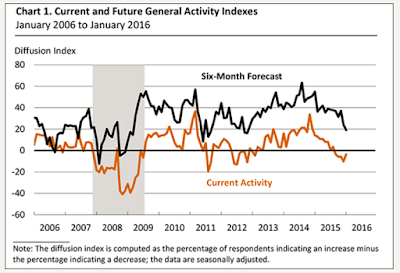

Manufacturing data from the Dallas Fed, along with that of the Kansas City Fed, have been offering the most striking evidence of oil-related contraction. Dallas’ general activity index came in at an extremely negative score of minus 34.6 for the January report which is the lowest reading since the beginning of the recovery in 2009.

New orders are falling deeper into contraction as are unfilled orders. Hours worked are now in the negative column as is employment. And finally falling into contraction — and in a big way — is the production index which had through last year, despite long weakness in orders, held in positive ground, but not anymore with the reading at minus 10.2 for a nearly 23 point monthly plunge. Price data in this report remain well into the minus column, at nearly double-digit monthly declines.

Manufacturing reports this month have been mixed, with this and Empire State pointing to another buckling but not the most closely followed report, the Philly Fed which is pointing to stability for the sector. Watch for the Richmond Fed report tomorrow and the Kansas City report on Thursday.

Production vs. Activity

Price of oil and gas is so low, production is a money-losing effort. This month we finally see the production spigots have been turned to low throttle. It’s a needed step for oil prices to bottom.

Mike “Mish” Shedlock