Economists expecting a huge surge in construction spending thanks to unusually warm December weather were no doubt shocked by today’s anemic report.

The Econoday Consensus Estimate was for +0.6% in a range of 0.3% to 1.3%, but not a single economist came close.

Held down by weakness in the nonresidential component, construction spending didn’t get a lift at all from the mild weather late last year, rising only 0.1 percent in December following a downwardly revised 0.6 percent decline in November and a 0.1 percent contraction in October. Year-on-year, spending was up 8.2 percent, a respectable rate but still the slowest since March last year.

But there is very good news in the report and that’s a very strong 0.9 percent rise in residential construction where the year-on-year rate came in at plus 8.1 percent. Spending on multi-family units continues to lead the residential component, up 2.7 percent in the month for a 12.0 percent year-on-year gain. Single-family homes rose 1.0 percent in the month for an 8.7 percent year-on-year gain.

Now the bad news. Non-residential spending fell 2.1 percent following a 0.2 percent decline in November. Steep declines hit manufacturing for a second month with the office and transportation components also showing weakness. Still year-on-year, non-residential construction rose 11.8 percent.

Rates of growth in the public readings are led by highway & streets, at a 9.4 percent surge for December and a year-on-year rate of plus 12.0 percent. Educational growth ended 2015 at 9.4 percent with state & local at plus 4.4 percent. The Federal subcomponent brings up the rear at minus 1.4.

Lack of business confidence and cutbacks for business spending are evident in this report but not troubles on the consumer side, where residential spending remains very solid and a reminder that the housing sector is poised to be a leading driver for the 2016 economy. Still, the weak December and revised November headlines are likely to pull down, at least slightly, estimates for revised fourth-quarter GDP which came in at plus 0.7 percent in last week’s advance report.

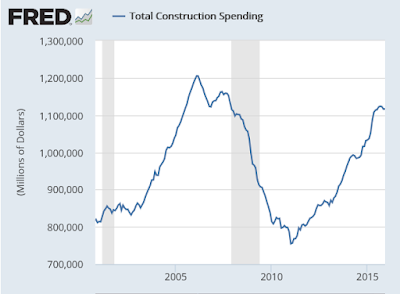

Total Construction Spending

Total Construction Spending Detail

Where to From Here?

Total construction spending has stalled since June 2015.

Bloomberg noted the “good news” in residential. Residential construction, especially single family homes, is more likely to be more opportunistic based on weather. New Wal-Mart superstores etc., are planned events.

It remains to be seen if “the housing sector is poised to be a leading driver for the 2016 economy“.

I strongly suspect “not”.

Mike “Mish” Shedlock