Earlier from the BEA: Gross Domestic Product, Fourth Quarter and Year 2021 (Advance Estimate)

Real gross domestic product (GDP) increased at an annual rate of 6.9 percent in the fourth quarter of 2021, according to the “advance” estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 2.3 percent….

The increase in real GDP primarily reflected increases in private inventory investment, exports, personal consumption expenditures (PCE), and nonresidential fixed investment that were partly offset by decreases in both federal and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.

emphasis added

On a Q4-over-Q4 basis, GDP was up 5.5%. An annual basis, GDP was up 5.7% in 2021 from 2020.

The advance Q4 GDP report, at 6.9% annualized, was above expectations, primarily due to a strong increase in inventories.

Personal consumption expenditures (PCE) increased at a 3.3% annualized rate in Q4.

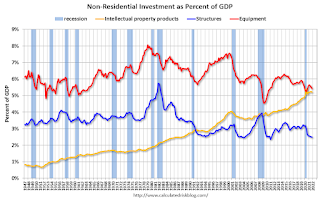

The graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So, the usual pattern – both into and out of recessions is – red, green, blue.

Of course – with the sudden economic stop due to COVID-19 – the usual pattern didn’t apply.

The dashed gray line is the contribution from the change in private inventories.

Residential investment (RI) decreased at a 0.8% annual rate in Q4. Equipment investment increased at a 0.8% annual rate, and investment in non-residential structures decreased at a 11.4% annual rate.

On a 3-quarter trailing average basis, RI (red) is down, equipment (green) is up, and nonresidential structures (blue) is still down.

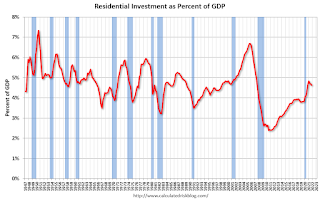

Residential Investment as a percent of GDP decreased in Q4.

I’ll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single-family structures, multifamily structures, home improvement, broker’s commissions, and a few minor categories.