From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 8.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 4, 2022.

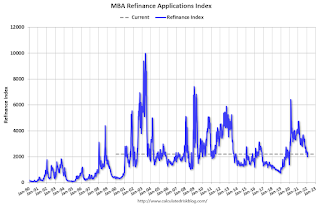

… The Refinance Index decreased 7 percent from the previous week and was 52 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 10 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 12 percent lower than the same week one year ago.

“Mortgage rates continued to edge higher last week, with the 30-year fixed rate climbing to 3.83 percent. Mortgage rates followed the U.S. 10-year yield and other sovereign bonds as the Federal Reserve and other key global central banks responded to growing inflationary pressures and signaled that they will start to remove accommodative policies. With rates 87 basis points higher than the same week a year ago, refinance applications continued to decrease,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase activity slowed after the previous week’s gain. Both conventional and FHA purchase applications saw proportional declines, resulting in purchase activity overall dropping 10 percent. The average loan size again hit another record high at $446,000. Activity continues to be dominated by larger loan balances, as inventory remains tight for entry-level buyers.”

…

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 3.83 percent from 3.78 percent, with points decreasing to 0.40 from 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

The first graph shows the refinance index since 1990.

The second graph shows the MBA mortgage purchase index

Note: Red is a four-week average (blue is weekly).