The key report scheduled for this week is the February employment report.

Other key reports scheduled for this week are ISM Manufacturing and February vehicle sales.

Fed Chair Powell presents the Semiannual Monetary Policy Report to the Congress on Wednesday and Thursday.

9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for a reading of 63.9, down from 65.2 in January.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for February. This is the last of regional manufacturing surveys for February.

8:00 AM: Corelogic House Price index for January.

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 58.0, up from 57.6 in January.

10:00 AM: Construction Spending for December. The consensus is for a 0.2% decrease in construction spending.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 320,000 payroll jobs added in February, up from 301,000 lost in January.

10:00 AM: Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 230 thousand from 232 thousand last week.

10:00 AM: Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

10:00 AM: the ISM Services Index for February.

8:30 AM: Employment Report for February. The consensus is for 400,000 jobs added, and for the unemployment rate to decrease to 3.9%.

8:30 AM: Employment Report for February. The consensus is for 400,000 jobs added, and for the unemployment rate to decrease to 3.9%.

There were 467,000 jobs added in January, and the unemployment rate was at 4.0%.

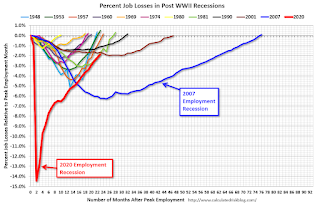

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 23 months after the onset, is now significantly better than the worst of the “Great Recession”.