The key report scheduled for this week is February CPI.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for February.

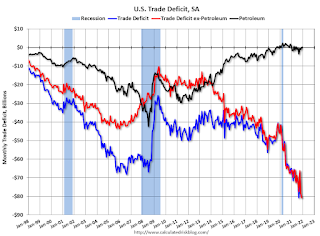

This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $87.1 billion. The U.S. trade deficit was at $80.7 Billion in December.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

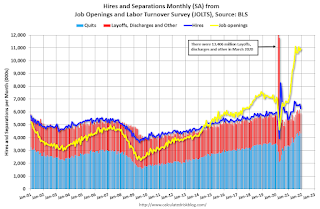

This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in December to 10.9 million from 10.8 million in November.

8:30 AM: The Consumer Price Index for February from the BLS. The consensus is for a 0.8% increase in CPI, and a 0.5% increase in core CPI. The consensus is for CPI to be up 7.9% Year-over-year (YoY), and core CPI to be up 6.4% YoY.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 210 thousand from 215 thousand last week.

12:00 PM: Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

10:00 AM: University of Michigan’s Consumer sentiment index (Preliminary for March).