The key reports this week are February Retail Sales, Housing Starts and Existing Home Sales.

For manufacturing, the February Industrial Production report and the March NY and Philly Fed manufacturing surveys will be released.

The FOMC meets this week, and the FOMC is expected to raise rates.

10:00 AM: State Employment and Unemployment (Monthly), January 2022

8:30 AM: The New York Fed Empire State manufacturing survey for March. The consensus is for a reading of 7.2, up from 3.1.

8:30 AM ET: The Producer Price Index for February from the BLS. The consensus is for a 0.9% increase in PPI, and a 0.6% increase in core PPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales ex-gasoline were up 4.2% in January.

10:00 AM: The March NAHB homebuilder survey. The consensus is for a reading of 81, down from 82. Any number above 50 indicates that more builders view sales conditions as good than poor.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to raise the Fed Funds rate by 25bps at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants’ projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: Housing Starts for February.

8:30 AM: Housing Starts for February.

This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.695 million SAAR, up from 1.638 million SAAR.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 225 thousand from 227 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for March. The consensus is for a reading of 15.0, down from 16.0.

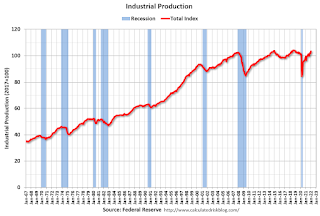

This graph shows industrial production since 1967.

The consensus is for a 0.5% increase in Industrial Production, and for Capacity Utilization to increase to 77.9%.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 6.16 million SAAR, down from 6.50 million.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 6.16 million SAAR, down from 6.50 million.

The graph shows existing home sales from 1994 through the report last month.