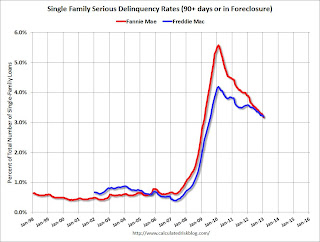

Freddie Mac reported that the Single-Family Serious Delinquency rate declined in January to 3.20% from 3.25% in December 2012. The serious delinquency rate is down from 3.59% in January 2012, and this is the lowest level since mid-2009.

The Freddie Mac serious delinquency rate peaked in February 2010 at 4.20%.

Fannie Mae reported earlier that the Single-Family Serious Delinquency rate declined in January to 3.18% from 3.29% in December 2012

Note: These are mortgage loans that are “three monthly payments or more past due or in foreclosure”.

Click on graph for larger image

Click on graph for larger image

Although this indicates some progress, the “normal” serious delinquency rate is under 1%. At the recent pace of improvement, it will take several years until the rates are back to normal.

NOTE: When Fannie Mae releases their annual report for 2012, I’ll post a graph of Real Estate Owned (REO) by Fannie, Freddie and the FHA (This is real estate that the agencies acquired through foreclosure or deed-in-lieu and haven’t sold yet). Both Freddie and the FHA reported that their REO declined in Q4, and the combined total will be at the lowest level since 2009. Also the FDIC reported that the dollar value of REO for FDIC insured institutions declined in Q4, and it appears the private label REO declined too.

Earlier on the employment report:

• February Employment Report: 236,000 Jobs, 7.7% Unemployment Rate

• Employment Report Comments and more Graphs

• All Employment Graphs