One of the core understandings of Monetary Realism is understanding how private investment is the backbone of private sector equity (we MR nerds use S=I+(S-I). It’s not as complex as some might think (and certainly not as overly simplistic as some others think). The identity essentially states that understanding private saving is about understanding how private saving is made up of private Investment plus the non-government’s surplus/deficit. So, our saving is not just the government’s deficit position (like t-bonds), but is also comprised of other assets that include claims against private sector entities.

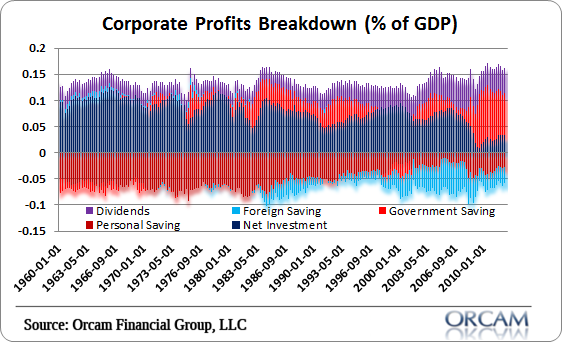

Understanding this balance is crucial for understanding the drivers of growth. For instance, I often post the chart showing the drivers of corporate profits over the last 50 years (see figure 1 below). It clearly shows that private investment drives corporate profits most of the time. And since the vast majority of private sector net worth is derived from claims against entities inside the private sector (like stocks, corporate debt, etc), well, you do the math.

The key point is, private investment is hugely important in driving the private sector’s health. And the key to understanding the environment of the last few years and the cause of the crisis has been largely about understanding this relationship. Those of us who understood it knew that the collapse in private investment was devastating. But we also knew that the surge in the government’s deficit (those bright red bars) would offset the decline in investment to a large degree. As I like to say, when the private sector’s “flow” turned off, the public sector’s “flow” turned on and kept spending, income and revenues higher than they otherwise would have been.

Knowing this, it’s nice to see this bit from Paul Krugman this afternoon where he essentially does S=I+(S-I):

“The blue line is government saving, roughly speaking (leaving some public investment aside) the public sector surplus or deficit; the red line is the private sector surplus, the difference between private saving and private investment. So yes, the budget deficit has soared — but it’s just offsetting a surge in the private sector surplus.

Now, this is almost an accounting identity, so by itself the figure doesn’t tell you which side is driving the action. But we know the answer to that question from other evidence. For one thing, we know that most of that surge in the private sector surplus reflects the collapse of the housing bubble, and that most of the surge in the public deficit reflected automatic stabilizers. For another, we know that if government deficits were crowding out private spending, we should have seen rising interest rates; what we actually saw was falling rates.”

Outside of a balance sheet recession, the private sector drives growth. But in this once in a lifetime debt based collapse, the public sector picked up the slack and drove growth. Understanding all of this is not just about understanding accounting identities, but about understanding how the different pieces of the money system all come together to generate a particular flow of funds in the system. Those who understood this did a vastly better job predicting the environment of the last 5 years than those who didn’t….

(Figure 1 – Corporate Profits as % of GDP)

The post Paul Krugman Does S=I+(S-I) appeared first on PRAGMATIC CAPITALISM.